The Ethereum blockchain has faced a major problem for years in terms of scaling. As the world’s second-largest blockchain, it often gets too busy and faces problems like congestion. This congestion causes very high transaction fees, known as gas fees, and slows the network down.

With the growth of decentralized applications, or dApps, solving this scaling issue became urgent. The answer has come in the form of Layer-2 protocols.

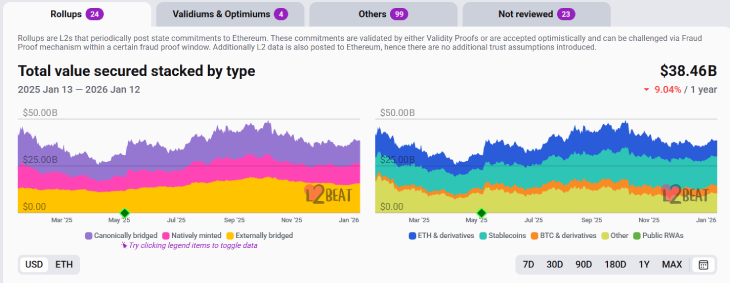

These are separate networks built on top of Ethereum’s main security layer. They process transactions away from the main chain, which makes them faster and cheaper, while still being secured by Ethereum. This ecosystem has exploded in value. The total value locked in Layer-2 networks surpassed $38 billion by early 2026, thanks to new technology called rollups.

In 2025, Ethereum solidified itself as the secure foundation for our growing digital civilization. From industry-leading adoption to new technology that reinforces protocol resilience, here are 12 themes that defined the past year:

1/ DeFi reinforced Ethereum’s role as the…

— Ethereum (@ethereum) January 6, 2026

However, it has also started intense competition known as the “scaling wars.” Different layer-2 networks are fighting to become the most used and achieve top place in the leaderboard. In the leaderboard of layer-2 scaling solutions, Arbitrum and Optimism have created their unique identity.

The Growing Adoption of Ethereum Layer-2 Scaling Solutions

Ethereum’s quest for scale started with early ideas like state channels and Plasma. These are expected to move transactions off the main chain. State channels, used by projects like the Raiden Network, allow users to interact privately off-chain.

(Source: L2BEAT)

They only settle the final result on the main Ethereum chain. Plasma was an early framework for sidechains. It set an example of high transaction throughput, though it ran into problems with data availability. It has since been mostly replaced by more advanced solutions.

The real turning point came with the introduction of rollups. Rollups work by bundling hundreds of transactions together into a single batch. This batch is then sent to the Ethereum mainnet. This process impressively cuts costs for users. There are two main kinds of rollups today.

The first is optimistic rollups. Protocols like Arbitrum and Optimism use this method. They assume all transactions are valid unless someone challenges them during a dispute period. They rely on fraud-proof to maintain security.

The second type is zero-knowledge rollups, often called ZK rollups. Networks like zkSync Era and Polygon zkEVM use this technology. They use complex cryptographic proofs to instantly verify transaction batches. ZK rollups offer stronger privacy and faster finality but require more computing power.

However, standard rollups are now the dominant force. They currently process more than 58% of transactions on the Ethereum network. A major upgrade to Ethereum in March 2024, called Dencun, has also fueled this growth.

Dencun introduced a feature called proto-danksharding, which is also known as EIP-4844. This created “blobs” of data that made data availability much cheaper for Layer-2s. The result was a dramatic drop in user fees. After Dencun, average fees on Optimism fell to around 4%.

Arbitrum Dominates Rollup Sector

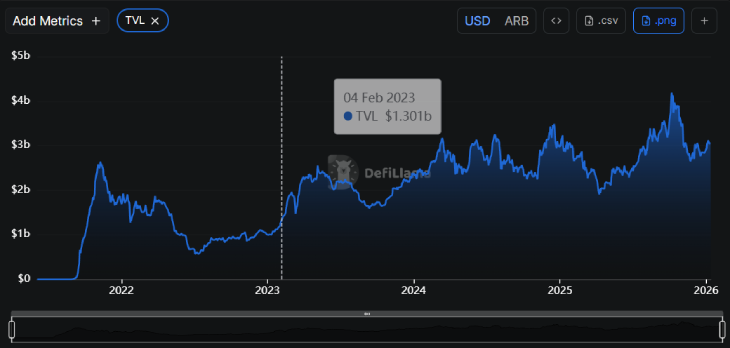

Arbitrum, developed by a company called Offchain Labs, is currently the largest Ethereum Layer-2 by total value locked. It secures over $3.053b billion in user assets. The network also holds more than 160,000 daily active wallets. It launched in 2021 and uses optimistic rollup technology with a multi-round fraud-proof system. This makes dispute resolution efficient. After the Dencun upgrade, it can handle up to 20 transactions per second with fees under 1%.

(Source: Arbitrum on DefiLlama)

This also makes it easy for developers to move their dApps from the mainnet to Arbitrum with few changes. It supports the Solidity programming language. Recently, it also introduced support for a new environment called Stylus.

Major DeFi applications have integrated with Arbitrum. These include giants like Aave, GMX, and Pendle. Popular gaming titles such as The Beacon and Wildcard also run on it. In 2025, Arbitrum launched an upgrade called ArbOS Atlas to fully match the Dencun upgrade. This further reduced fees and has saved users a combined total of over $11 billion in gas costs.

Optimism Develops the Superchain Ecosystem

Optimism has also taken an impressive approach to expand its boundaries. It is the developer of the OP Stack, which is a software toolkit for building Layer-2 chains. Optimism is using this to build what it calls a “Superchain.”

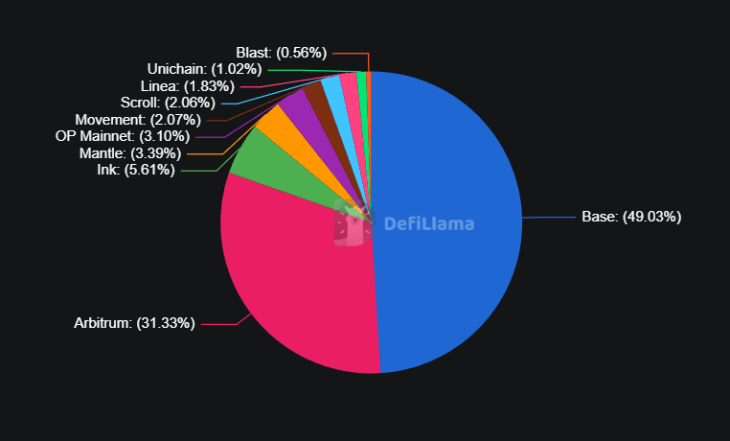

(Source: DeFiLlama)

This is a network of interconnected Layer-2 chains that can communicate with each other. The total assets secured across all chains using the OP Stack now exceed $17 billion, which comprises more than 50 different chains.

Optimism itself uses optimistic rollups. Its design comes with a single-round fault-proof and very fast block times of 200 milliseconds. User fees are extremely low, often around $0.001. The network now handles roughly 15% of all cryptocurrency transactions.

Apart from this, its modular framework allows others to build highly customizable blockchains. These new blockchains can enable what is known as horizontal scaling.

A major development for Optimism’s technology came from the crypto exchange Coinbase. Coinbase has created its own Layer-2, called Base, using the OP Stack.

Another major exchange, Kraken, is also building on it. These integrations have brought millions of users into the ecosystem. In 2025, Optimism announced a program for OP Token Buybacks. It also integrated with a liquid staking protocol called Ether.fi.

The Scaling War of Layer-2 Solutions

While the DeFi ecosystem is rapidly expanding, the Layer-2 solution sector is becoming highly competitive.

(Source: DeFiLlama)

At present, Arbitrum, Optimism, and Base have a very strong hold on the market. Some analyst firms like Longbridge suggest that this could lead to the decline of smaller, less competitive networks by 2026. While ZK rollup chains like zkSync and Polygon zkEVM are providing technological advantages in speed and finality, these optimistic rollups are still leading in terms of total value locked and user activity.

For example, Base has witnessed a huge surge in use after Dencun and frequently leads in total transaction count across the ecosystem.

While the community is aiming to boost the L2 ecosystem, Nethermind founder Tomasz Stanczak revealed that the L2 scaling still remains unfinished.

Conclusion

While Layer 2 solutions are continuously taking the world by storm, Ethereum’s Layer-2 networks are entering what Grayscale Research calls the “dawn of the institutional era.” Also, under U.S. President Donald Trump’s crypto-friendly administration, the decentralized finance sector is expected to boom in 2026. This will accelerate the use of Layer-2s for services like asset custody, lending, and handling tokenized real-world assets.

In this ongoing scaling war, leading Layer-2 solutions, like Arbitrum and Optimism, are expected to boost Ethereum’s mass adoption.

Also Read: Quantum Threat: Could Quantum Computing Break Bitcoin’s Security?

See less