Key Highlights

- In recent years, the tokenization of RWAs has grown thanks to regulatory clarity and institutional demand

- On the other hand, the DeFi sector is still struggling to resolve issues like liquidations on major protocols during a catastrophic situation in the crypto market

- At the time of writing, the total value locked in RWAs is revolving around $25 billion, with a surge during the downfall in the crypto market

As of now, the cryptocurrency market is struggling to hold its position above $68,000 and is facing an extreme downward trend. In 2025, Bitcoin climbed above its previous bull cycle’s all-time high. But after that, the crypto market faced extreme volatility due to different macroeconomic factors and depleting institutional investments.

At the time of writing this, the total market capitalization is revolving around $2.32 trillion, according to CoinMarketCap.

Most people think that the crypto market is gaining momentum and holding this market capitalization just because of everyday traders who trade to gain profits through leveraged trading and activities in the DeFi sector, like yield farming.

However, the reality is very different. There is a new trend that is gradually taking place. In this new trend, many major institutions and entities are gradually investing their money into tokenized real-world assets (RWAs).

Tokenization of Real World Assets (RWAs) Become New Trend

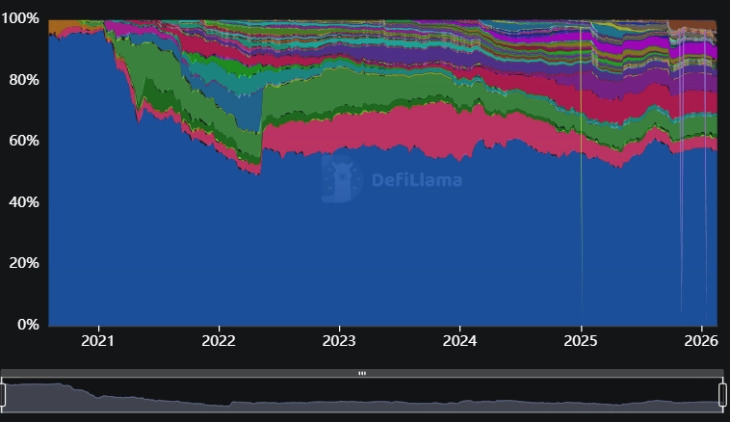

The total value locked in the DeFi ecosystem is revolving around $96.5 billion. This is too low from its highs of $120 billion.

(Source: DefiLIama)

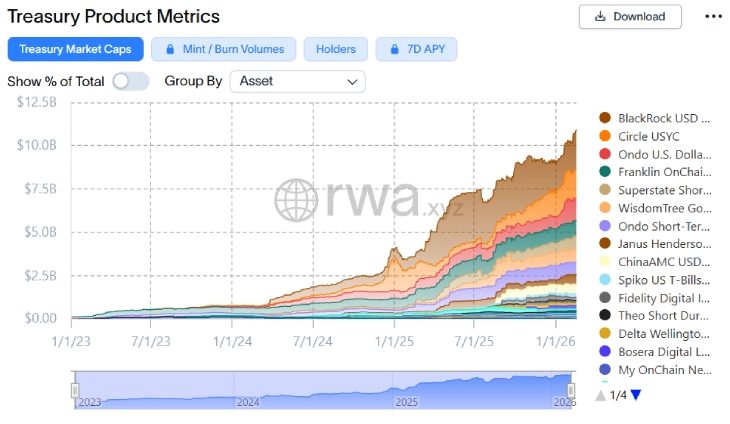

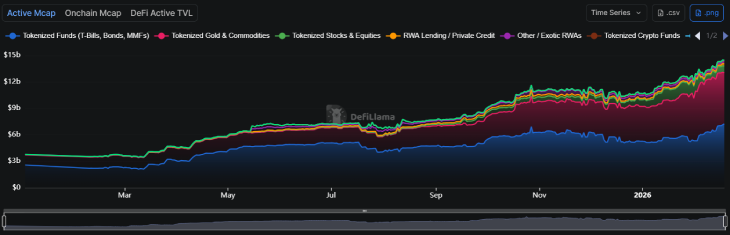

Compared to this, the RWA sector is new but still growing rapidly. According to the on-chain data, the sector has reached $25.03 billion in distributed asset value. Over the last 30 days, while the crypto market is facing a correction, this new sector has witnessed growth by 12.55%.

(Source: rwa.xyz)

What makes this sector unique is its ability to attract regulated investment assets. For example, tokenized U.S. Treasuries are now an account for $10.93 billion in total value. That is around 44% of the entire RWA market. Many investors are continuously putting their money into these products, despite the turmoil in the crypto market.

This is not a temporary hype like that witnessed during the early days of non-fungible tokens (NFTs). This has a very powerful structure as its underlying assets have intrinsic value in the real world.

RWAs are becoming an alternative choice for those investors who are less interested in anonymous protocol yields that could disappear overnight due to a minor bug in the code or a governance attack.

Institutional Money in RWAs Increases

BlackRock’s BUIDL fund, which is developed on Ethereum with the help of Securitize, is now holding around $2.2 billion. This makes it the largest single product in the RWA sector. After this, another popular project comes, which is Circle’s USYC with $1.7 billion. Apart from this, there is Ondo’s USDY, which holds around $1.3 billion, and Superstate’s USTB holds $781 million.

(Source: defillama)

In these investment products, investors get steady returns. They pay around 4% to 5% annual yields, which is backed by short-term US government debt. Apart from this, investors also get off-chain redemption rights and regulated custody of assets. In other words, they can get their money out through traditional transactions if needed.

Now, let’s compare this scenario with DeFi lending. Aave and Compound are two leading protocols in the DeFi sector. Together, these two protocols have seen their total value locked plunge below $15 billion. The true yield has shrunk because too much money is chasing very few opportunities. Repeated liquidations in the DeFi sector increase the risk, where borrowers get wiped out when the token’s price drops sharply.

There are many risks associated with the DeFi sector for institutional investors. In the last few years, various bridge exploits and oracle manipulation attacks destroyed billions of dollars of investments overnight. For treasuries and asset managers, this is a very risky space. But in the RWA sector, they can avoid such risks.

Ondo Finance is a major example of this revolution. Its tokenized Treasury and money market products surpassed $2.5 billion in total value locked in January 2026.

These are not retail investors’ money flowing into this sector. Instead, the growth in RWA holders is directly linked to qualified purchasers, which joins this sector via regulated platforms like Securitize and Centrifuge.

RWA Sector Gets Regulatory Clarity

In recent years, the discussion around digital regulations has increased, thanks to pro-crypto administrations and lawmakers.

In the United States, the Trump administration is actively working on establishing clear regulations for the crypto sector. U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins has shared his view on tokenization.

He stated in the press release, “To the entrepreneur who wants to build here in America and is willing to comply with clear rules, we should offer more than a shrug, a threat, or a subpoena. To the investor trying to discern the difference between buying a tokenized share of stock and buying a collectible in a video game, we should offer more than a web of enforcement actions.” Paul Atkins believes that the tokenization will change capital markets within a few years.

The SEC has issued guidance, which makes clear that tokenized securities must follow existing federal securities laws. This will provide clear guidelines to follow instead of operating in the dark and living in fear of legal challenges. Apart from this, the agency also closed its probe against Ondo Finance without filing any charges. This shows that the agency has finally changed its hostile stance against the digital asset sector.

The GENIUS Act created a federal framework for stablecoins, which allows banks to issue regulated digital dollars. Many RWA products depend on these stablecoins. Also, there are new regulatory frameworks like the CLARITY Act, which is in its advanced stage.

Europe has also introduced theMiCA framework. It provides a single framework for rules for tokenized securities across the European Union. Ondo Finance has already secured approval to offer tokenized US stocks and ETFs in 30 EEA markets. This gives the company access to more than 500 million investors.

Conclusion

While the DeFi sector is still juggling to decide direction, RWAs have already made their unique identity among institutional investors in a short period of time. Apart from this, it avoids risks like liquidation witnessed in the DeFi protocols. This sector is rapidly growing along with much-needed regulatory clarity. So, there is no doubt that tokenization of real-world assets will grow significantly in the upcoming years, and it can also beat the DeFi sector.

Also Read: Top Privacy Coins to Watch in 2026 Amid Quantum Threats

See less