Key Highlights:

- Bitcoin ETFs saw huge money flow out of them yesterday on February 3, 2026.

- XRP ETFs saw the highest inflow amongst the other altcoins.

- ETH and Solana also experienced inflows, however, SOL dropped below the $100 mark.

Crypto ETF flows sent mixed signals as investors seem to be currently adjusting their positions across major assets. Bitcoin ETFs faced massive outflows on February 3, 2026 and dragged BTC prices down to about $76,000. However, other major ETF products for ETH, XRP and SOL managed to bring in inflows as per SoSoValue Data.

XRP ETFs Gain Traction

XRP ETFs saw an inflow of $19.5 million and the majority of it came from Franklin’s XRP ETF. This product managed to bring in $12.13 million alone. The second largest inflow was observed by Bitwise’s XRP ETF, which brought in $4.82 million, as per SoSoValue data.

The XRP ETF products did not see an outflow yesterday however, 21Shares XRP ETF product did not see either inflow or outflow and remained flat for the day.

This positive sentiment could be because of the fact that Ripple got an approval as an Electronic Money Institution in Luxembourg, which is a huge step for licensing and legitimizing XRP usage in regulated financial systems.

Ethereum ETFs Snap Outflow Streak

Ethereum ETFs posted a net inflow of $14.06 million. With this inflow, the ETF products end a streak of three days of outflows. Big investors put most of their money into BlackRock’s Ethereum ETF, adding about $43 million, showing confidence in Ethereum’s growth and rewards from staking, as per SoSoValue data.

At the same time, Fidelity’s Ethereum ETF saw around $55 million being pulled out. Even though more money came in overall than what went out. This indicates that the investors may be feeling a little positive again.

Solana ETFs Edge Positive

Solana ETF also saw a small amount of inflow, which was about $1.24 million as per SoSoValue Data. Fidelity’s Solana ETF got the most of it, which was $1.19 million. VanEck’s ETF product, however, saw an outflow of $650,000, as per SoSoValue data. Even though the ETF products saw an inflow but the price of the token has dropped below the $100 mark as per CoinGecko.

Bitcoin ETFs Hit Hardest

A huge amount of money moved out of the spot Bitcoin ETF yesterday, February 3, 2026. The ETF product experienced an outflow of $272 million. The biggest outflow was seen bleeding from Fidelity’s Bitcoin ETF, where investors pulled out nearly $149 million. However, BlackRock was an exception because it actually saw an inflow of $60 million, indicating that major players are still buying, as per SoSoValue data.

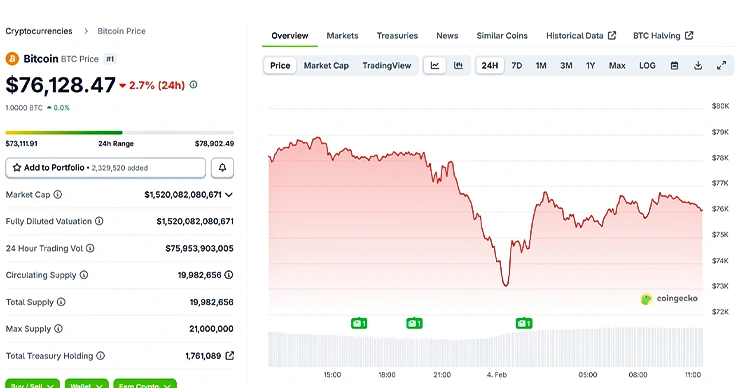

With all this money flowing out of the ETF products has also affected the price of Bitcoin today. The price of BTC is now down to $76,000. At press time, the price of the token stands at $76,128.47 with a drop of 2.7% in the last 24-hours as per CoinGecko. The Fear and Greed index has also dropped down to 14, which indicates extreme fear within the market.

Final Thoughts

The data above suggests that the investors are now rotating their money. Bitcoin faced selling pressure and the capital moved to Ethereum, XRP and Solana. XRP saw the highest inflow yesterday, because of the regulatory clarity.

Also Read: SOL & XRP ETFs Lead Jan 2026 Inflows; BTC & ETH Bleeds