Key Highlights

- On November 17, ETH dropped below the support level of $3,000 after witnessing massive liquidation

- Bitcoin has also plunged below $92,000, sparking a panic sell in the crypto market

- Despite a major drop, Tom Lee believes that ETH could hit $7,000 in the next 45 days

The ongoing turmoil in the cryptocurrency market has pushed the second-biggest cryptocurrency, Ethereum, below the support level of $3,000. This sharp decline in cryptocurrency sparked a panic in the crypto community about volatility in the crypto market.

Bitcoin (BTC) has also witnessed a similar downward trend, pulling down its valuation below $92,000, according to CoinMarketCap.

Ethereum Hits Key Liquidation Zone as Analysts Stay Confident

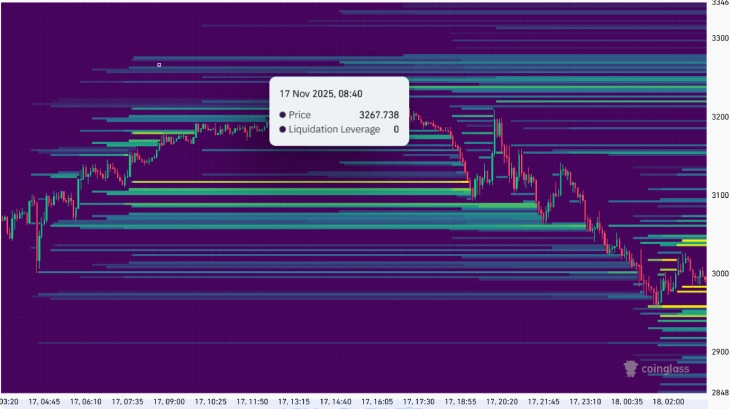

(Source: Coinglass)

According to Coinglass, 164,696 traders were liquidated, and the total liquidations came in at $894.65 million in a day. At the time of writing, Ethereum is trading at around $2,982.37 with a 3.97% drop on the daily chart. Bitcoin is trading at around $91,448.19 with a 2.98% drop in 24 hours. The overall market capitalization of cryptocurrency has also taken a hit, shrinking to $3.1 trillion.

$ETH has a liquidity cluster around the $2,900-$3,000 level.

With BTC showing weakness, I think Ethereum will sweep that level.

On the upside, ETH has some decent liquidity around the $3,600 level. pic.twitter.com/TAGk4XJrnx

— Ted (@TedPillows) November 17, 2025

According to Ted, a crypto analyst on X, Ethereum has a major concentration of trading liquidity in the range of $2,900 to $3,000. In the past, this support zone has often functioned as a price magnet.

While Bitcoin is showing weakness, the analyst believes that Ethereum will move down to sweep that lower support zone. On the other hand, for any upward momentum, the analyst has marked another major liquidity pool near the $3,600 level. It could also become a major resistance point for the cryptocurrency.

Tom Lee, executive chairman of BitMine Immersion Technologies (BMNR), head of research at Fundstrat Global Advisors and chief investment officer at Fundstrat Capital, said in an interview that Ethereum is probably bottoming this week.

JUST IN: Tom Lee Says #Ethereum Will Bottom This Week pic.twitter.com/7JH6gggYjQ

— Altcoin Daily (@AltcoinDaily) November 17, 2025

However, he still believes that ETH will hit $7,000 in the next 45 days with a surprising breakout. Lee shared his optimism by citing the boom in stablecoins on Ethereum and the new trend of tokenization.

“Crypto prices have not recovered since the liquidation event on Oct 10th. And the lingering weakness has the hallmarks of a market maker (or two) suffering from a crippled balance sheet,” he said. “When a market maker has a ‘hole’ on their balance sheet, they are seeking to raise capital and are reducing their liquidity functions in the market. This is the equivalent of QT (quantitative tightening) for crypto and has the effect of dampening prices. In 2022, this QT effect lasted for 6-8 weeks. And this is probably happening today.”

Tom Lee said, “When a market maker has a ‘hole’ on their balance sheet, they are seeking to raise capital and are reducing their liquidity functions in the market. This is the equivalent of QT (quantitative tightening) for crypto and has the effect of dampening prices. In 2022, this QT effect lasted for 6-8 weeks. And this is probably happening today.”

Ethereum Grows Its Ecosystem via Fusaka Upgrade and Stablecoin Trend

Ethereum blockchain is likely to see a major upgrade, the Fusaka upgrade, in December. This upgrade introduces PeerDAS (EIP-7594), which allows nodes to sample Layer-2 blob data randomly, cutting storage demands by up to 90%, and boosting scalability.

This hard fork with 13 EIPs, including Verkle Tree for better verification, is expected to reduce fees and provide enhanced throughput. It will also provide fuel for Layer-2 growth for dApps and RWAs.

According to Vitalik Buterin, this upgrade will be a major milestone for the Ethereum network ahead of full Danksharding and Glamsterdam.

Another big trend that is taking place on the Ethereum blockchain is stablecoin. After the approval of the GENIUS Act, the stablecoin market has witnessed sharp growth in recent months. As Ethereum dominates the stablecoin market by hosting major stablecoins like USDT and USDC, the network could become a major player for cross-border transactions.

Also Read: CZ Responds to $4.3B Refund Claims, Vows to Reinvest in America