Ethereum (ETH) Seems to be One of the Biggest Losers in ERC20 List

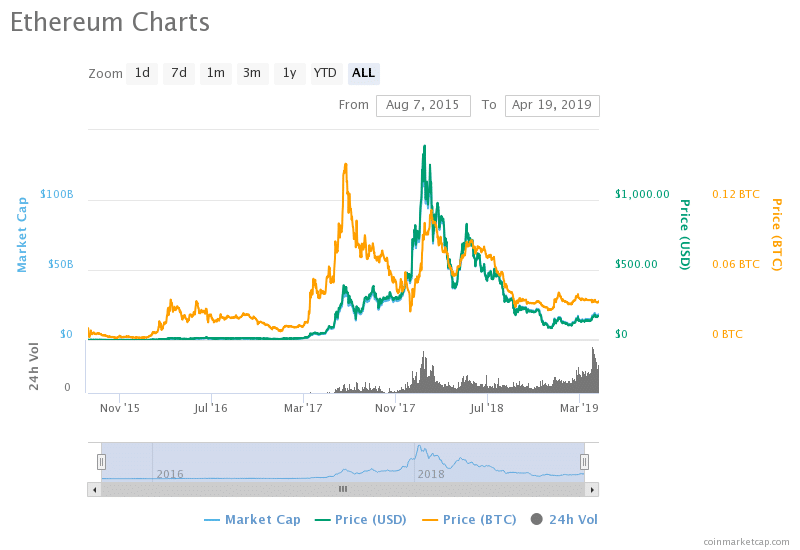

Recently top cryptocurrency research and news portal, Messari has published a report stating that Ethereum coin (ETH) is one of the Top 10 ERC20 compliant coins to have faced abrupt downward movement after the 2018 bearish market or the crypto winter. As per the report, Ethereum’s all-time high was 1431.77 USD, and currently, the coin’s value is hovering around 81 USD.

In the aftermath of the 2018 bear market that saw Ethereum fall from an all-time high of $1,431.77 to $81.15, $ETH faces a larger break-even multiple than most of the 10 largest ERC 20 tokens. pic.twitter.com/yRuQp8oqwx

— Messari (@MessariCrypto) April 18, 2019

ERC20 Token-

ERC20 is technical protocol standard which implies some specific rules regarding smart contracts and token on Ethereum’s network. ERC stands for Ethereum Request for Comments. It should be noted that most of the tokens issued on the Ethereum blockchain network are ERC20 compliant. As per the latest data, 181,799 tokens on the Ethereum blockchain network are based on ERC20 protocol. The ERC20 crypto assets can be traded like any other crypto coins, but they lack their own blockchain platform, rather depend on Ethereum’s platform.

Advantages of ERC20-

- The ERC20 has brought uniformity in technical as well as protocol standard.

- The nitty-gritty of the token implementation process has been simplified.

- The liquidity of the ERC20 tokens has increased in the market due to increased certainty.

- The risk of not honoring a contract has also reduced.

The fall of Ethereum-

The market for Ethereum token fell like anything in 2018. The all-time high price is almost 10 times the current price. There are certain reasons attached to the fall.

Market Correction-

As Ethereum has bubbled in a speed it was never meant to, a market correction was expected. It is normal for any asset to have market corrections at regular intervals. Many major coins like Bitcoin (BTC), Ripple (XRP), etc. have been through it.

FOMO-

This implies the fear of missing out. As the value started to increase, the hype over the internet got built up. This added many investors pushing the price to an even bigger level. This attracted many speculators as well.

Impatience-

As the crypto market was filled with speculators, the patience factor was missing from the investors. This led to crowding out by investors.

Bubble Crypto-

There is no denying that the crypto bubble is yet to be busted. There are many factors like speculation, panic, fear is present in the market. So, a swift and small change has a much bigger domino impact on the coins.

Ethereum’s Current Position-

Since its inception, Ethereum (ETH) has been subject to gradual growth. But the 2018 crypto winter is what made the distinction. In just a month’s time, the value rose to as high as 500 %. The boom was unexpected. But it could not maintain the momentum. The current market cap of Ethereum stands at 18,180,475,660 USD on 19th April at 08:34 UTC. And the value of each coin in terms of USD and BTC stand at 171.97 USD and 0.03281692 BTC. The current 24 h volume at the same UTC stands at 6,591,355,785 USD. It ranked at 2 in the whole crypto market with 5977.64 % of ROI. The total Ethereum coins in circulation stand at 105,720,812 ETH.

Since its inception, Ethereum (ETH) has been subject to gradual growth. But the 2018 crypto winter is what made the distinction. In just a month’s time, the value rose to as high as 500 %. The boom was unexpected. But it could not maintain the momentum. The current market cap of Ethereum stands at 18,180,475,660 USD on 19th April at 08:34 UTC. And the value of each coin in terms of USD and BTC stand at 171.97 USD and 0.03281692 BTC. The current 24 h volume at the same UTC stands at 6,591,355,785 USD. It ranked at 2 in the whole crypto market with 5977.64 % of ROI. The total Ethereum coins in circulation stand at 105,720,812 ETH.

Comparison-

The market boom has inflated the value of Ethereum Token by a large margin. On January 14, 2018, the market cap of Ethereum Token (ETH) was 133,588,759,230 USD. And the value of each coin was 1377.72 USD. The current market cap has enormously degraded by 86 % in these 15 months. The same way the value of each coin has deflated by 87.51 %. The market has felled downward growth all through the duration. It has risen in between for a few days, but it could not sustain the momentum.

Prediction-

The Price is now hovering around 165 USD to 170 USD. The value will definitely rise, as per our ETH Price Forecast. As market correction has already happened, it may go swift from now onwards. The next resistance should be there at 182 USD. But, the long-term outlook seems bullish. The falling trend has gone past. Long-term investors should not worry much now. They should realize a good percentage of profit by 2019.