- The Cardano price gives an upside breakout from the resistance trendline of the falling wedge pattern to intensify its bullish breakout and chase $0.4 mark.

- Grayscale Investments increased Cardano’s weighting in its Smart Contract Fund to 20.07% as of February 19, 2026.

- The momentum indicator RSI at 46% accentuates a neutral to bearish sentiment among market participants.

Cardano, the eleventh largest cryptocurrency by market capitalization is up roughly 4% to trade $0.283. ADA’s uptick moved in lockstep Bitcoin following the U.S. Supreme Court decision striking down certain presidential tariffs. However, the Cardano price gained additional traction as Grayscale investment increased ADA’s share in its Smart Contract Fund, indicating increasing conviction in the asset’s long term value.

ADA Allocation Rises to 20% in Grayscale Smart Contract Fund

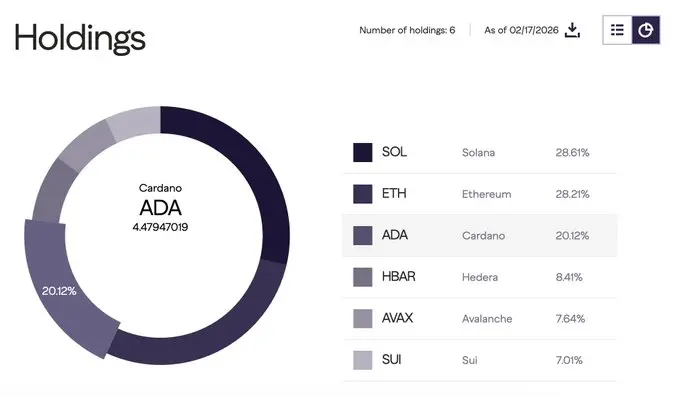

Grayscale Investments has made changes to its Smart Contract Fund portfolio with Cardano (ADA) now taking a 20.07% weighting in the portfolio as of February 19, 2026. This puts ADA third in the fund’s holdings, behind Solana (SOL) at 28.58% and Ethereum (ETH) at 28.41%.

The remaining allocations are as follows: Hedera (HBAR) with 8.40%, Avalanche (AVAX) with 7.67% and Sui (SUI) with 6.87%.

This latest change represents an increase of 0.52% points from early February. Since November the ADA holdings have been up nearly 5 percent points. The incremental increase represents a series of small, consecutive increases, as opposed to one big rebalance.

The fund provides diversified exposure to platforms competing in decentralized finance and application infrastructure, so changes in allocations are watched as indicators of institutional positioning.

Some market participants have highlighted Cardano’s continued work to increase its decentralized finance capabilities, including any efforts that are linked to bitcoin-based collateral and lending structures. However, no direct link between those developments and Grayscale’s decisions on allocation have been confirmed.

While not enormous in absolute terms, the move reflects further institutional exposure to Cardon via organised investment products.

Cardano Price Eyes Leap to $0.4 Amid Wedge Pattern Breakout

For the past three weeks, the Cardano price has been wavering below the $0.3 resistance level, reflecting lack of initiation from buyers or sellers. While the broader market uncertainty persisted, the coin buyers managed to breach the resistance trendline of falling wedge pattern at $0.288.

Since October 2025, the ADA price resonated within the pattern’s two converging trendlines, driving a steady correction trend. Therefore, the recent breakout signals a change in market dynamic, further reinforced by a sharp surge in momentum indicator RSI to 45%.

With today’s jump of over 4%, the coin price offers a suitable follow-up to the bullish breakout from the wedge pattern. The post-breakout rally could push the asset roughly 50% to $0.432 resistance, followed by a surge to $0.485.

On the contrary, if sellers fail to hold above the breakout point at $0.27, the coin price could reenter the wedge pattern range and highlight the previous breakout as invalid. The failed breakout could accelerate the selling pressure as haste long-positioned traders could get trap, and face liquidation.

Also Read: XRP ETFs See 83% Spike in 24 Hours As Institutional Interest Returns