- The Bitcoin price is less than 1% short from challenging the bottom trendline of a bearish reversal pattern called head and shoulder.

- Crypto derivatives traders faced severe stress as nearly $300 million in long positions were liquidated

- Momentum indicator RSI at 31% indicates aggressive bearish momentum in BTC with price nearing close to the oversold region.

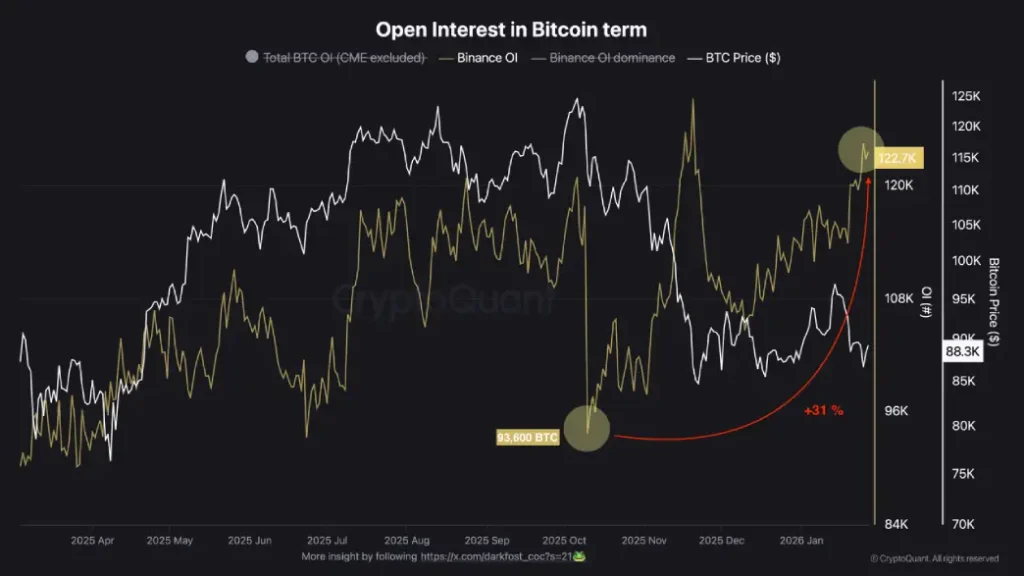

On January 31st, the crypto market recorded another downtick which extended correction for the majority of major cryptocurrencies including BTC. By press time, the Bitcoin price trades at $82,873, registering a loss of 1.5%. Despite the recent market volatility, open interest tied to BTC continued to surge, signaling that the risk appetite among investors is intact. While this may not reinforce a particular direction, the holders must brace for potential volatility.

Crypto Leverage Amplifies Losses While Bitcoin Price Finds Support

Financial markets experienced a synchronized and sharp decline recently with risk assets and traditional safe havens coming under pressure. Gold prices were down about 8%, and silver was down even more, by almost 12%.

However, the Bitcoin price showed notable resilience as its price plunged to a low of $81,000 with 5% loss on Friday, but reverted immediately to during the late U.S. market hours. That said, Major stock benchmarked such as S&P 500 and the Nasdaq recorded significant loss during the same period

The main trigger seemed linked to new information coming out of Microsoft about its commitments in developing artificial intelligence. The company’s stock suffered a more than 12% drop in response to the event, touching off a chain reaction that extended through interconnected global exchanges and sectors.

Despite the relatively contained fall of Bitcoin, the derivatives action showed extreme fragility amongst leveraged participants. Long positions amounting to almost $300 million faced forced closures in a matter of hours. Decentralized platform Hyperliquid took the biggest hits with $87.1 million in eliminated long positions. Centralized exchange Binance suffered much less severe effects, at around $30 million (about a third of Hyperliquid’s tally), despite the fact that it has a strong presence in overall trading turnover.

This dynamic shows the constant appeal of high-leverage setups in crypto markets. Such strategies regularly amplify small changes in prices into cascading volatility due to the margin calls and position unwinds. The trend remains even after the severe October 10 disruption of last year, which caused widespread capital erosion and evaporation in liquidity in the sector.

Binance’s futures data, which is expressed in units of Bitcoin not in terms of dollar value to eliminate the effect of price, gives a better lens into the commitment levels of traders. Open interest currently registers at around 123,500 BTC. This figure now surpasses the pre-October 10 figure of 93,600 BTC, which translates to an approximate 31% recovery in exposure since this low-point.

The pattern suggests returning participant interest and renewed build up despite periodic shakeouts.

This Breakdown Could Drive Major Correction in BTC

Over the past two weeks, the Bitcoin price has plummeted from $97,350 to $82,902, registering a loss of 15%. While the downtrend aligns with broader market downturn amid macro economic uncertainty and geopolitical tension, BTC’s chart reveals a potential formation of classic bearish reversal pattern.

The chart analysis highlights the recent downturn as part of the head and shoulders pattern. Theoretically, the chart setup is characterized by a left shoulder, a long-middle head, and right shoulder before the decisive breakdown.

Currently, the Bitcoin price is just inches away from challenging the neckline support at $82,500. A potential breakdown may indicate a major bear market potential of BTC with immediate support positioned at $80,500 followed by $74,600 and $70,000.

Alternatively, if the crypto buyers managed to defend the bottom trendline, the coin price could enter a short consolidation above $82,500 to renew its bullish momentum.

Also Read: Solana Sees Sharp Validator Exodus as Staking Power Concentrates