Key Highlights:

- Mt. Gox has received an extension on its repayment deadline, which was earlier set for October 31, 2025.

- This extension is focused on resolving remaining procedural and technical issues.

- The trustees are prioritizing precision instead of speed.

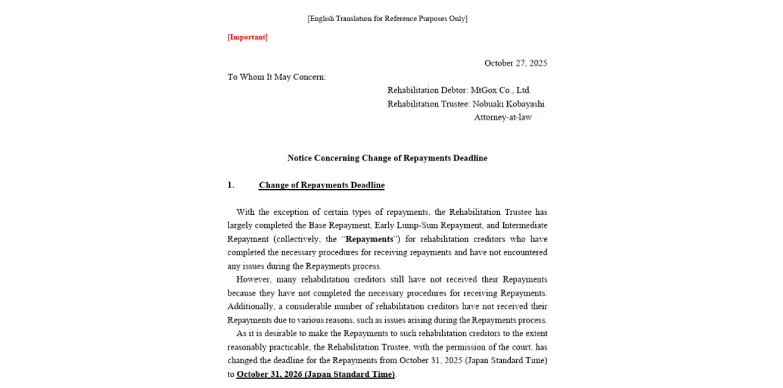

Mt. Gox. Co., Ltd., once the world’s largest Bitcoin exchange, has received an extension on its repayment deadline which was originally set for October 31. 2025. The new repayment deadline has been set for October 31, 2026 (Japan Standard Time). The push has been approved by the Japanese Court and has been confirmed by Nobuaki Kobayashi, the court-appointed rehabilitation trustee who is managing the long-running repayment process for the exchange.

With this extension, there will be yet another delay in the decade-long effort to return funds to the creditors who collectively lost thousands of Bitcoin during the infamous 2014 hack. According to Kobayashi’s official statement, the revised timeline allows additional time to resolve procedural issues and make sure that all eligible creditors receive their repayments properly.

Ongoing Repayment Efforts

According to the trustee’s announcement, the repayment categories (Base Repayment, Early Lump-Sum Repayment, and Intermediate Repayment) have been largely completed for creditors who finalized all required procedures and faced no system errors. These payments made up the main portion of the distribution plan, which was initially scheduled to finish by October 31, 2025.

However, Kobayashi highlighted that a large number of creditors are still awaiting repayment. The reason behind this wait is incomplete applications, challenges in verification processes, and technical difficulties encountered during the process (system errors, KYC mismatches, and data confirmation issues). The statement further adds that some payments were delayed because of the problems that appeared after the repayment process began.

With the new deadline of October 31, 2026, the court wants to provide enough time to the trustee and his team so that they can address all of these challenges and make sure the widest possible repayment coverage for the affected users. The trustee also thinks that the extension is necessary because it will help the exchange manage the administrative workload, verify system operations, and maintain fairness across all creditor groups.

Long Road to Repayment

Mt. Gox’s bankruptcy is still one of the oldest and most closely followed stories in crypto history. During its prime, the Tokyo-based exchange Mt. Gox managed more than 70% of the global Bitcoin trading. Mt. Gox went bankrupt back in 2014, as almost 850,000 BTC were lost due to theft and poor management. This incident sent shockwaves throughout the cryptocurrency world.

Since the beginning of this rehabilitation process, Nobuaki Kobayashi and the Mt. Gox team have been focused on recovering and redistributing the remaining assets to its affected creditors. The team had to undergo various proceedings and asset recovery efforts, after which Tokyo District Court finally approved the rehabilitation plan in 2021, allowing repayments in fiat currency, Bitcoin (BTC) and Bitcoin Cash (BCH).

By 2025, many of the verified creditors will have received at least a few partial payments through licensed exchanges that are currently acting as transfer agents. However, as we can see, the delays still exist, which is especially difficult for international claimants as they face jurisdictional verification hurdles or difficulties accessing their registered crypto accounts.

Persistent Challenges but Renewed Progress

This is the third time that the repayment deadline has been postponed, and this just indicates the complex logistical challenges of distributing large amounts of both digital and fiat assets under Japan’s bankruptcy laws. However, the recent announcement indicates that the extra year is intended to ensure that there is a comprehensive completion of the repayment process.

Although the crypto community was hoping that this year would be the end of Bitcoin’s earliest and most infamous scandal, but the new 2026 deadline highlights that the trustees want to prioritize on precision and procedural integrity rather than on speed.

Also Read: Trump Nominates Pro-Crypto Michael Selig as CFTC Chairman