Key Highlights

- On November 17, the NYSE approved the listing and registration of the Canary Marinade Solana ETF, clearing the road before its launch

- This ETF still requires final approval from the SEC, after which it could begin trading on the Cboe exchange in the upcoming weeks

- This new trend of Solana ETFs comes after recent regulatory statements on staking tokens

As per the latest update, the New York Stock Exchange (NYSE) has approved the listing and registration of the Canary Marinade Solana ETF. With this approval, this new SOL ETF is one inch away from going live for trading.

“We further certify that the security described above has been approved by the Exchange for listing and registration upon official notice of issuance. We understand that the Registrant is seeking effectiveness under the Form 8-A 12(b), and we hereby join in such request,” stated in the official document.

Canary Marinade Solana ETF Prepares to Go Live

With the approval from the NYSE, a new SOL ETF is expected to go for market debut in the United States. The approval comes with a fast-track process after the Securities and Exchange Commission (SEC) approved updated generic listing standards, which allow products like the Canary Marinade Solana ETF to proceed.

This new ETF could become a hot favorite for those investors who want to take advantage of staking tokens, as it passes through 100% of the staking rewards to investors.

The ETF now requires final approval from the SEC and could begin trading on the Cboe exchange in the upcoming weeks.

However, the ongoing downward trend in the cryptocurrency market has also affected SOL. At the time of writing, SOL is trading at around $131.25 after a 21.67% drop in a week, according to CoinMarketCap.

Solana ETFs Debut Amid Market Volatility

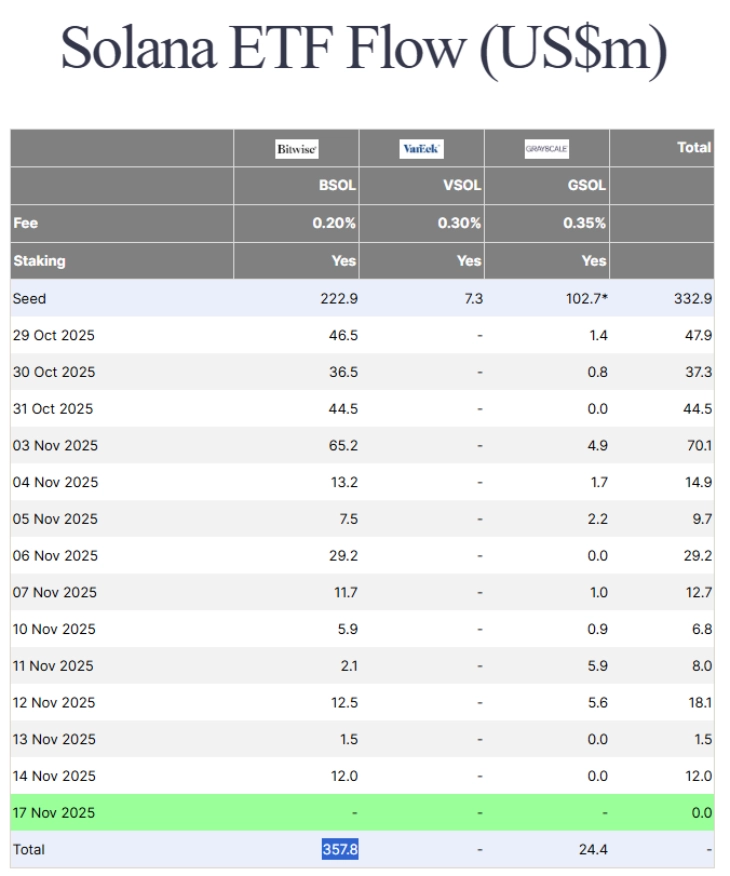

The United States has witnessed another major trend in late October with the launch of the first Spot Solana ETF. The Bitwise Solana Staking ETF began trading on the NYSE Arca on October 28. On its first day, BSOL attracted an inflow of 46.5 million, according to Farside. Since the launch, the Solana ETF has maintained a positive streak of inflows. The total amount invested in BSOL since the ETF launched revolves around $357.8 million, making it the biggest Solana ETF.

(Source: Farside)

BSOL is also designed to offer direct exposure to SOL. Also, it partnered with Helius to stake 100% of its holdings to allow the fund to provide investors with over 7% in annual staking yields.

The launch of BSOL also encouraged other ETF issuers to join the party and launch their own products. The day after Bitwise’s launch, Grayscale also introduced its Solana Trust ETF on the NYSE Arca. This ETF converted Grayscale’s existing closed-end fund into a new spot ETF product that comes with staking rewards. To date, GSOL has witnessed a total inflow of $24.4 million. While this investment is constant, it is still small compared to Bitcoin ETFs.

The competition in the market intensified in mid-November when VanEck entered the market with its VanEck Solana ETF, which began trading on the Cboe BZX exchange. As the second U.S. spot Solana product to include staking, VanEck adopted an impressive strategy to entice investors by waiving all management fees for the first $1 billion in assets or until February 17, 2026, whichever comes first, according to the press release.

One of the major reasons behind the boom in Solana ETFs is the latest regulatory guidelines from authorities that opened doors for staking-based ETFs. In August, the SEC’s Division of Corporation Finance released a statement, in which they clarified that certain liquid staking tokens are not securities.

“It is the Division’s view that “Liquid Staking Activities” (as defined below) in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, it is the Division’s view that participants in Liquid Staking Activities do not need to register with the Commission transactions under the Securities Act, or fall within one of the Securities Act’s exemptions from registration in connection with these Liquid Staking Activities,” stated in the official statement.

Also Read: Amid Bitcoin Slump, Strategy Expands Corporate Holdings