- On-chain data from Santiment shows several major crypto coins trading below the recent holders’ average cost basis.

- The Bitcoin price consolidates around $67,000, to rebuild sufficient momentum for the next leap or dive.

- The crypto fear and greed index at 15% suggest the broader market sentiment is strongly bearish.

On Friday, February 20th, the cryptocurrency market witnessed a slight uptick of roughly 1% as its market capitalization jumped to $2.33 Trillion. The buying pressure can be attributed to macro economic developments as the U.S. Supreme Court struck down President Trump’s recent tariff regime. However, the buying pressure short-lived as Trump found a new legal authority to impose a 10% global tariff on all imports. As a result, the majority of major crypto coins including Bitcoin, Ethereum, XRP, Cardano, and Chainlink witnessed overhead supply. A recent on-chain analysis highlights which of these assets are currently undervalued.

These Crypto Coins Enter Undervalued Zone as MVRV Signals Holder Losses

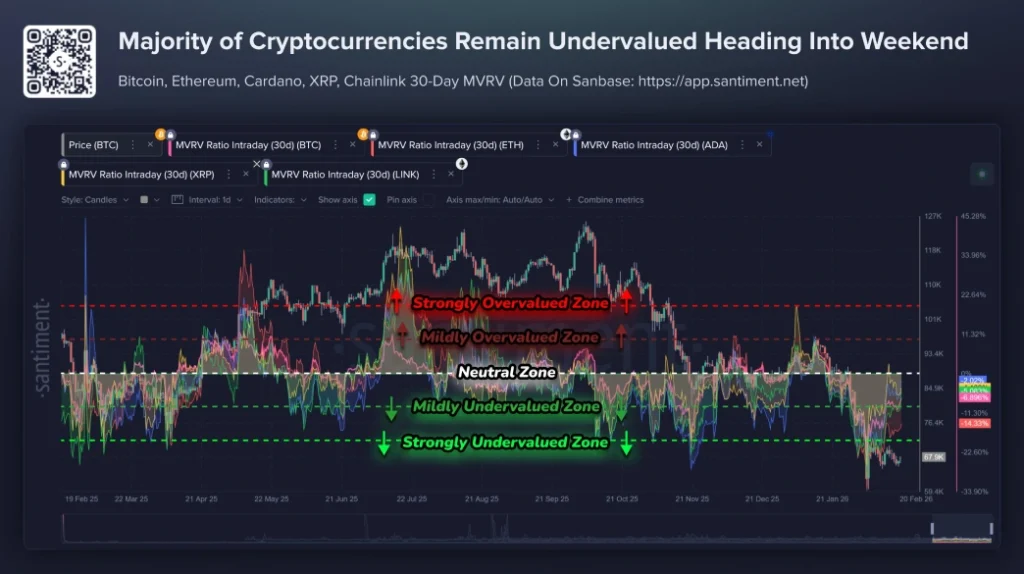

On-chain analytics platform, Santiment, shows that a number of leading cryptocurrencies are now trading below the average cost basis of recent holders, as per the 30-day Market Value to Realized Value (MVRV) ratio. This metric compares the market price of an asset to the price that coins last changed hands, which points to periods where short-term participants are facing losses.

Ethereum takes the lead with a reading of about -14.3% which is a strong indication of significant unrealized losses among wallets active in the past month. Bitcoin registers at around -6.9% and Chainlink is around -5.1%. XRP is down -4.1% and Cardano is down a more moderate -2.0%. All five assets are in zones that are mildly to strongly undervalued on historical charts.

Multi-month visualizations of these intraday 30-day ratios show that there are frequent oscillations over defined levels: high levels in the form of overpricing, a central neutral zone, and low levels in the form of depressed valuations. Recent movements have bumped most of the lines to the bottom portions after previous highs.

Derived from aggregated data of blockchain transactions, the MVRV provides a holder-centric view of market conditions. The accompanying chart aggregates these indicators for Bitcoin, Ethereum, Cardano, XRP and Chainlink, showing how they have a common position in territory of lower valuations as of mid-February 2026.

Bitcoin Price Analysis

Over the past two weeks, the Bitcoin price has traded in a narrow range of $73,000 to $62,200, marked by the daily candle of February 5th. The consolidation followed a major downtrend that offered traders to recoup their momentum before the next leap.

A potential breakout from overhead resistance will drive a renewed recovery push to $80,000.

On the contrary, a breakdown below the $62,200 could extend the correction trend to $55,000.

Ethereum Price Analysis

Similar to other crypto coins, the Ethereum price showed a consolidation trend over the past two weeks. However, the sideways action resonating within two converging trendlines indicate the formation of a bearish pennant pattern.

On February 18th, the coin price gave a downside breakdown from the pattern’s support trendline. With sustained selling, ETH could plunge another 17% and retest a long-coming support trendline at $1,600.

Cardano Price Analysis

On February 14th, the Cardano price gave a bullish breakout from the resistance trendline of a falling wedge pattern. Since October 2025, the coin price witnessed a steady downtrend within the pattern’s conversion trendline, before the recent breakout signals change in market dynamic.

With sustained buying, the ADA price could jump to 50% up to challenge the $0.42 resistance.

Chainlink Price Analysis

The daily chart analysis of Chainlink price shows a classic bearish continuation pattern called inverted flag. Following a sharp correction, the chart setup offers a short breather with relief rally to recoup its exhausted bearish momentum.

A potential breakdown from the pattern’s support trendlines at $8.7 will accelerate the selling pressure and push LINK to $7 mark.

XRP Price Analysis

Among the aforementioned crypto coins, the XRP showed a bullish outlook as its price rebounded from the support trendline of a channel pattern. The chart setup is characterized by two trendlines that act as dynamic support and resistance.

If the bullish momentum persists, the XRP price could surge 25% up to challenge the overhead trendline at $1.78 for another breakout.