Key Highlights

- On January 8, Polygon Labs launched the Open Money Stack for the “next evolution of Polygon.”

- The stack integrates very important infrastructure components, including blockchain rails, cross-chain transfers without bridges, fiat on/off-ramps, and built-in compliance tools.

- This launch comes amid the growth in the $3.3 billion on-chain stablecoin market, which also aligns with its 2026 roadmap

On January 8, Polygon Labs made a huge announcement, in which the company introduced the Open Money Stack. This is a complete infrastructure framework designed to change global payments.

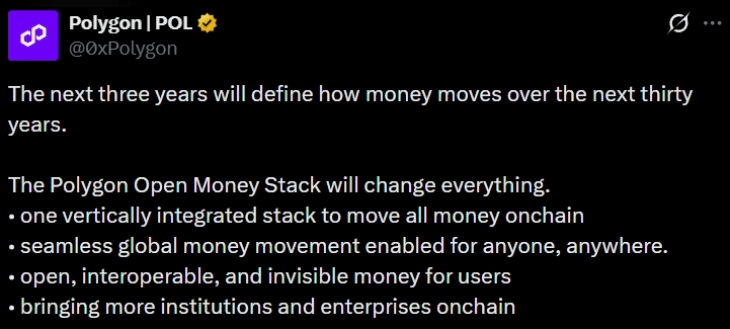

Today, we release our vision for the next evolution of Polygon.

It’s a simple idea with massive implications:

money should move as freely as information does on the internetWe’ll do this through one vertically integrated stack of onchain solutions.

This is the Polygon Open… pic.twitter.com/snLn2Q0Nnj

— Sandeep | CEO, Polygon Foundation (※,※) (@sandeepnailwal) January 8, 2026

Co-CEOs Sandeep Nailwal and Marc Boiron shared their vision on X (formerly Twitter), where they aim to create a future where money moves as easily as information online.

The purpose is to utilize blockchain technology for easy and instant transactions. This new stack is expected to connect traditional money systems with blockchain systems. This new launch is trying to solve the current problems of fragmentation in global payments. It also put the Polygon network as a main part for finance, powered by stablecoins.

What is Polygon’s Open Money Stack

The Open Money Stack is built on 6 years of real work by Polygon. During this time, the network has handled over $2 trillion in on-chain value. The stack brings many parts together, which include high-performance settlement layers and deep liquidity for stablecoins.

(Source: Polygon on X)

It also includes tools to manage transactions across different blockchains. Apart from this, it has built-in compliance features that are part of the design. Its important components are blockchain rails, which can be shared or dedicated.

There is also a wallet-as-a-service for smooth user entry. The stack provides a way to change regular money into stablecoins and back again. It allows cross-chain transfers without using bridges or swaps.

It also includes basic financial tools on-chain, like yield generation and card programs. Other parts are indexers, RPCs, identity management, and interoperability protocols like AggLayer. The purpose behind this new launch is to make the technical chains “invisible” to the user by removing gas fees and delays.

Sandeep stated in the post X, saying that “Polygon is already winning in payments and now we are entering this exciting new phase. It’s an evolution of what we’ve been building over the past six years.”

“Polygon’s DNA has been to onboard real-world utility onchain and we have been absolute trailblazers on the same. We have been trusted by global enterprises like Stripe, Flutterwave, Calastone, Shift4, and financial institutions alike, including JP Morgan, BlackRock, HSBC, Franklin Templeton, and Mastercard. It’s only now that blockchains are picking up an actual real-world use case, which is growing exponentially. And that is Stablecoin-based money rails.”

“It is the one use case where blockchain rails are undeniably better than traditional financial infrastructure. The legacy payment rails are structurally broken. Money hasn’t kept up with how the digital world works. With this, we finally find ourselves right at home, right where our zone of genius lies, bringing real-world utility on-chain, bringing all money movement onchain,” he said.

How Does Open Money Stack Work

The main function of this framework is to support payments using regulated stablecoins. It allows businesses to bring customers from the traditional financial system directly into the on-chain ecosystem.

For example, a payment from someone in São Paulo to someone in Lagos could settle in seconds. This is much faster than traditional systems, which often have many middlemen, higher costs, and slow timelines. The system also allows idle funds earn yield automatically.

This turns every transfer into a chance for passive income. Polygon states that the stack is modular and chain-neutral. It means that fintech companies, institutions, and large enterprises can customize it for their needs while still following regulations.

This announcement comes as the on-chain stablecoin market grows. The supply of stablecoins on-chain reached a 3-year high of $3.3 billion by late 2025. Sandeep Nailwal stated that this is about making money instantly, globally, and programmably.

Marc Boiron called it the missing plumbing to fix infrastructure gaps. Many parts are already live through partnerships, with more coming in the next few months. Pilot programs are expected later in 2026.