Key Highlights

- On November 18, SOL surged over 8% after witnessing a drop of over 10% in a weekly chart, climbing to $141.27

- This spike in SOL price comes after the launch of three major ETFs from Fidelity, Canary Capital, and VanEck

- The price surge in SOL follows a correlation with Bitcoin, which also soared by 1% on a daily chart

On November 18, Solana (SOL) witnessed a major spike in its value after a brand new Solana ETF from Canary Capital went live.

According to CoinMarketCap, SOL is trading at around $141.07 with an 8.6% jump in the last 24 hours. After witnessing a massive crash of over 10% in a weekly chart, this sharp spike possibly signals a rebound in its price. Its market capitalization has also surged by around 8.76%, reaching around $78.2 billion.

VanEck, Fidelity, and Canary Capital Launch Solana ETFs

One of the major factors behind the spike in Solana prices is the launch of two major Solana ETFs from Fidelity and Canary Capital on the same day.

Fidelity, one of the world’s largest traditional asset managers, has also launched its Solana ETF on the NYSE Arca. This ETF fund comes with a management fee of 0.25% and is designed to track the spot price of SOL. Also, it promises to provide investors with an annual yield between 5-7%.

After receiving a green light from the NYSE for registration and listing yesterday, Canary Capital, an investment management firm, quickly rushed to launch its Canary Marinade Solana ETF on the Nasdaq exchange. One of the unique parts of this investment product is its partnership with Marinade Finance, which is a leading decentralized finance protocol. The ETF uses an innovative structure that enables 100% staking and distributing rewards among its investors.

VanEck, the leading asset management firm, has also announced the launch of its new VanEck Solana ETF under the ticker VSOL. To stand out as unique among its competitors, it has announced a temporary full waiver of its sponsor fee. However, this waiver will apply to the first $1 billion in assets under management and is expected to remain in effect until February 17, 2026.

“It is the Division’s view that “Liquid Staking Activities” (as defined below) in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, it is the Division’s view that participants in Liquid Staking Activities do not need to register with the Commission transactions under the Securities Act, or fall within one of the Securities Act’s exemptions from registration in connection with these Liquid Staking Activities,” stated in the official statement.

“Solana has quickly emerged as a leading proof-of-stake network, offering speed, scalability, and efficiency that continue to attract developers and real-world use cases,” Kyle DaCruz, Director, Digital Assets Product with VanEck, stated in the press release. “We’re excited to be launching VSOL and to build on VanEck’s long history of expanding access to digital assets through thoughtful, investor-focused products.”

Solana ETFs are gradually attracting investors’ attention. After the launch of the first SOL ETF from Biwise on October 28, institutional investors have started diversifying their portfolio by investing in it. While inflows in SOL ETFs are not as substantial as Bitcoin ETFs, this ETP has maintained a streak of positive inflows for over a week. As of now, BSOl has accumulated inflows of $365.1 million.

Solana Prepares for Rally as Downside Liquidity Clears

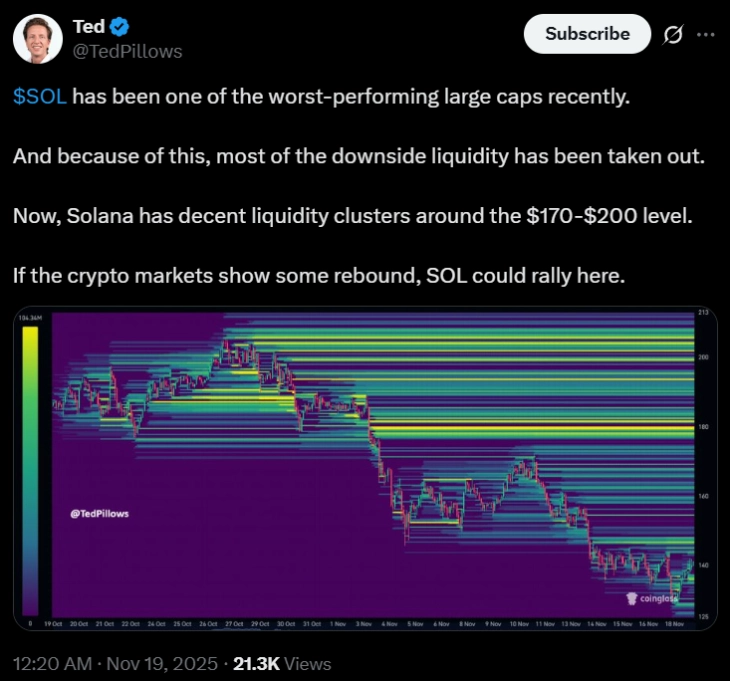

According to Ted, a crypto analyst on X, SOL has recently underperformed compared to other major cryptocurrencies. However, this low performance has had a cleansing impact on the market, as a major amount of downside liquidity has been exhausted.

(Source: Ted on X)

The crypto analyst believes that there is a substantial cluster of supportive liquidity in the price range between $170-$200.

However, the current turmoil in the cryptocurrency market has wiped out a significant amount of investments. After the first major liquidation on October 10, following Trump’s declaration of war trade against China, the cryptocurrency market is witnessing a downward trend, wiping out billions of dollars of investments.

After dipping below $92,000 on November 17, today, Bitcoin is showing a sign of recovery with a 1.57% surge in the last 24 hours. The second biggest cryptocurrency, Ethereum, has also soared over 4.53% on a daily chart.

The reason behind the boom in SOL ETFs is the regulatory agency’s recent statement on liquid staking tokens, where it revealed that certain liquid staking activities are not considered the Issuance of securities.

Also Read: Mt. Gox Moves 10K BTC; Bitcoin Falls to $89K. Bear Cycle Ahead?