As Bitcoin sustained crowns above the $87,000 mark, Solana, the sixth-biggest cryptocurrency, trades at $138. With a 4% surge over the past seven days, Solana holds a market cap of $71 billion.

Currently, it faces opposition to surpass the $140 mark, despite signaling a potential trend reversal. Will the bullish struggle lead to the $150 breakout rally? Or is the $131 retest inevitable? Let’s find out.

Solana Price Analysis: SOL Gains 30% in Two Weeks

In the daily chart, the Solana price analysis showcases a bullish breakout of a falling wedge pattern. With the wedge breakout rally, Solana heads to the $140 mark. This accounts for a price surge of nearly 30% over the past two weeks.

Based on the Fibonacci levels, the recovery run in the breakout rally has surpassed the 23.60% retracement at $131. Furthermore, the recovery run prolongs the positive trend in the MACD and signal lines.

This signals a high possibility of an extended gold run. Furthermore, the Solana price exceeds the red line of the Supertrend indicator at $136. This marks the beginning of a new positive trend as per the technical indicator.

As the 23.60% Fibonacci level breakout run struggles to surpass the $140 mark, the bulls are unlikely to reach the $150 psychological level. This strong resistance level coincides with the 38.20% Fibonacci retracement.

Nevertheless, with a post-retest turnaround from the 23.60% level, Solana will likely witness a prolonged recovery rally. Optimistically, the $150 breakout will reach the $185 level near the 61.80% Fibonacci retracement.

On the flip side, the 23.60% Fibonacci level breakdown will likely reach the $120 mark.

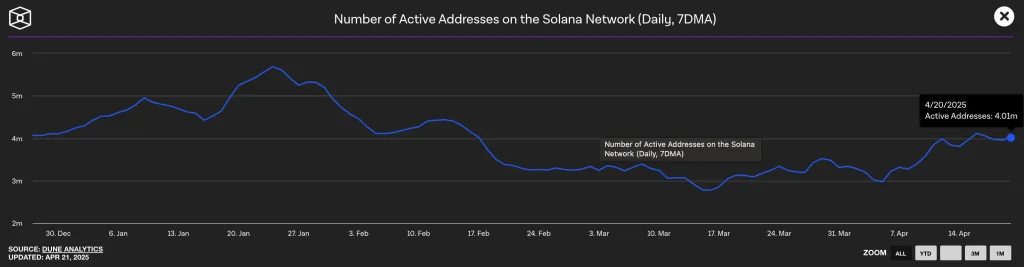

Active Addresses Jump Over Solana Network

As Solana prepares for an extended rally, the number of active addresses on the network witnesses a significant surge. In April, the number of active addresses on the network has jumped from a 30-day low of 2.97 million to the current stand at 4.01 million.

This marks a significant surge in activity, increasing the possibility of increased demand for Solana.

Will Bulls Dominate Solana Derivatives?

In the derivatives market, Solana has witnessed a 1.66% surge in open interest, reaching $5.38 billion. This marks a positive increase in the trader’s interest as Solana recovers.

Furthermore, the negative funding rate is gradually declining, reaching -0.0051% over the past 24 hours. Amid the chances of positive recovery, the long positions in the Solana derivatives have crossed the 50% barrier.

This propels the long/short ratio above the 1 threshold, increasing the possibility of a new bull run.

Read more: XYZ Meme Coin Hits $13M ICO, Eyes Shiba Inu & Solana Success