- Since early November, the Solana price has been resonating within the formation of falling wedge patterns.

- The open interest tied to SOL futures contracts witnessed a notable $7.68 in recent weeks, accentuating the increasing speculative force in the market.

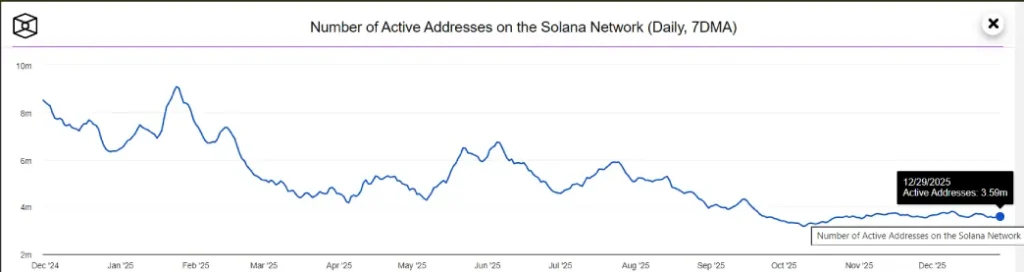

- Solana Active wallet count has stopped declining and remains steady above 3.5 million count.

SOL, the native cryptocurrency of layer-1 blockchain Solana shows a short spike of over 1.4% on Tuesday, to reach $124.6 trading volume. The uptick gained initial momentum from broader market bullishness, but retailed its growth as the derivatives market data, and on-chain analysis offered additional support. As a result, the Solana price is inches away from challenging a key resistance to bolster its price recovery.

Rising Open Interest Signals Growing Speculative Confidence in Solana

Over the past two weeks, the Solana price has been wavering in uncertainty around the $125 level. The daily chart showed a series of short-bodied candles with long-wick rejection indicating lack of initiation from buyers or sellers.

While the consolidation aligns with broader market FUD, the derivative data tied to Solana highlights a renewed interest from speculative traders. According to CoinGlass data, the open interest associated with SOL futures contracts has bounded from $6.9 billion to $7.68 Billion within a fortnight, registering a 11% growth.

This surge indicates fresh speculative capital entering the market. Traders appear to be building positions rather than exiting, suggesting conviction in Solana’s potential for a rebound despite macro caution.

In addition, the prevailing downtrend in the number of active addresses has started to stabilize above 3.5 million count. Since early October, the active addresses count has witnessed a moderate rebound to currently hold at 3.5 million. This stabilization — despite consolidation of prices — suggests that there is no collapse in core network use.

Overall, these two signals — rising futures open interest and stabilizing on-chain activity — indicate that Solana’s fundamentals are not so bad underneath the surface-level market hesitation. While price action has been range-bound with macro pressures coming into play, the effect of the combination of speculative inflows and consistent user engagement could create a setting for a stronger recovery.

Solana Price Poised Imminent Breakout Form Wedge Pattern

The ongoing correction trend in Solana price has started to resonate within two converging trendlines in the daily chart. The dynamic resistance and support revealed a classic bullish reversal pattern called Falling Wedge. Theoretically, the pattern highlights weakening bearish momentum as price started to record shallow lower-low formations.

With an intraday gain of 1.4%, SOL price trades at $124, challenging the pattern’s key resistance trendline for bullish breakout. If the price flips the overhead barrier into potential support, the buyers could strengthen their grip over this asset for renewed recovery.

The post-breakout rally could push the price 17% up to challenge the key psychological resistance at $148-$150. However, the potential retest stands as a key pivot level for buyers as 100-day exponential moving average and another downsloping trendline at $150 could stall buyers’ motive.

On the contrary, if the sellers continued to defend the overhead trendline, the coin price could witness a prolonged correction trend entering 2026. The momentum indicator RSI at 45% accentuates negative market sentiment and reinforces potential of further downtrend.