As South Korea prepares to lift its ban on institutional cryptocurrency investments, the government is introducing stricter anti-money laundering (AML) and Know Your Customer (KYC) requirements for crypto exchanges and banks working with institutional clients.

South Korea Gears up For Stricter Crypto Rules

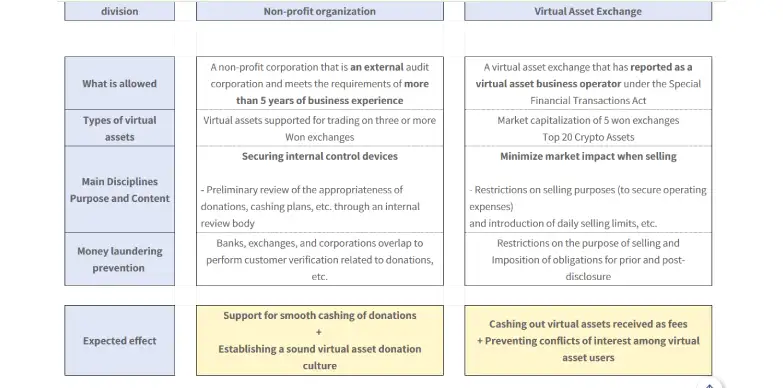

Starting in June, registered cryptocurrency exchanges and certain non-profit organizations will be allowed to sell digital assets they already hold. Non-profits can liquidate donated crypto, while exchanges can sell portions of crypto earned from transaction fees.

The country’s Financial Services Commission (FSC) announced that new institutional clients must undergo enhanced verification procedures. Exchanges and their partner banks will be required to thoroughly assess the origin of funds and the intended purpose of crypto transactions. These measures are introduced to reduce the risk of money laundering and maintain stability in the financial system.

These enhanced Know Your Customer (KYC) protocols are part of a broader effort to safeguard the domestic crypto and financial markets from money laundering threats, the FSC emphasized. As part of the crackdown, both financial institutions and their CEOs will be subject to monitoring for any suspicious activity linked to money laundering.

The Korea Federation of Banks and the Digital Asset Exchange Association (DAXA) are expected to relay these new guidelines to exchanges and banks by the end of the month.

South Korea remains one of the world’s most active crypto markets, with about 9.7 million people, using crypto exchanges as of the end of 2024. It is thus no surprise that just like the US, in South Korea too, crypto has become a key political issue ahead of the June presidential election, with both leading candidates expressing support for legalizing spot crypto exchange-traded funds (ETFs). This policy shift aligns with the ruling People Power Party’s broader seven-point plan to strengthen South Korea’s presence in the global crypto market. The plan also includes easing restrictions on partnerships between banks and crypto platforms.

However, unlike in the United States, a Bitcoin reserve is clearly not under consideration in the Asian region, for now. Recently, the Bank of Korea stated that it “has never considered including Bitcoin in its foreign exchange reserves.”

Congressman and member of the Planning and Finance Committee, Che Guigen (transliteration) added, “We believe that we need to be cautious about including Bitcoin in our foreign exchange reserves.”

The Bank further noted, “While some countries, such as the Czech Republic and Brazil, have shown a positive stance on this issue, institutions like the European Central Bank (ECB), the Swiss National Bank, and the Japanese government have all expressed opposition.”

Also Read: Point Zero Forum 2025: Shaping the Future of Finance Amid Disruption