Theta Network seems in trouble; Should you invest in THETA?

Theta Network is a decentralized content delivery platform with high bandwidth blockchain facilities running on smart contracts. Theta Lab, the founder of Theta Network, aims to disrupt the streaming video platforms with this decentralized network. Currently, YouTube and Netflix are popular centralized streaming platforms that are thriving in the market.

Theta Lab aims to compete with such big whales with its decentralized ecosystem with better video quality and faster communication. They are also focusing on crypto-based gaming solutions, which need both content creators and consumers, along with sponsors, developers, and advertisers on the network.

At the time of its launch, it was an ERC-20 token, but it launched the main net in 2019 when ERC-20 tokens were exchanged with native THETA tokens in a 1:1 ratio. It runs on a Proof of Stake consensus, which is energy efficient, and token holders need to stake a certain amount of THETA coin to qualify as a validator of this network.

Indeed, it can potentially change the steaming ecosystem in the future. If you want to be an early stakeholder of THETA coin, read our THETA forecast.

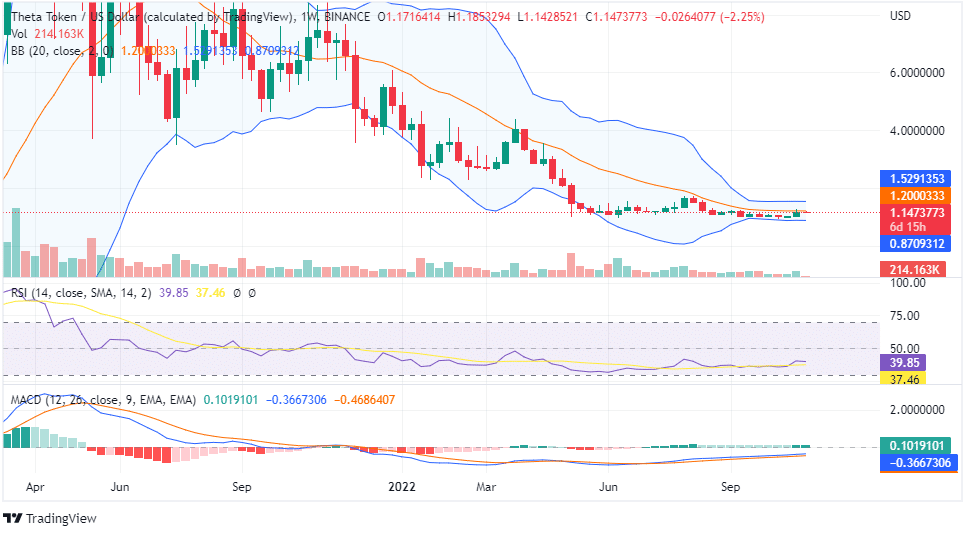

After taking support for around $0.904, THETA has been in an uptrend. Though the last two daily candles are red, we think it is an ideal time to buy for the short term. However, it may come further below, which also could be a better time to buy for the short term.

Most technical indicators are bullish, suggesting positiveness. However, it can be a risky investment if you do not buy it at the support level. We think you should add it to your watchlist and invest when it will take support or consolidate within a range.

On the weekly chart, THETA candlesticks are forming in the lower range of the BB and consolidate within a range of $1.2 and $0.8. We can find two bullish candles in the last two weeks, but this week, it is forming a red candle that suggests a further consolidation for the next few weeks. We think a lower value of the consolidation range would be an ideal time to buy for the short term or accumulate the coin for the long term.