Key Highlights:

- BTC and ETH ETFs saw year-end outflows, XRP and SOL drew interest.

- December 30 was the day that marked a strong rebound across all ETFs.

- January inflows showed renewed investor confidence post-holidays.

As 2025 ended, US spot crypto ETFs showed a great mix of trends between December 29 and December 31. Bitcoin and Ethereum ETFs saw money flowing out as investors booked profits and adjusted their portfolios right before the new year commenced. This profit booking is very common practice and is also known as the year-end rebalancing.

At the same time, XRP and Solana ETFs stood out as they attracted almost $40 million in fresh inflows. This inflow indicates that some investors continue to shift towards altcoins instead of exiting the crypto market altogether.

According to the data that has been gathered from Farside Investors and SoSoValue, on December 30, 2025, all major crypto ETFs categories recorded inflows. This was because of a broader market rally that was sparked by the US Federal Reserve that indicated a pause in interest rate hikes. This announcement pushed the risk appetite and lifted the broader crypto market.

This interest was then further noticed on January 2, as investors returned after the holidays and poured more money into the crypto ETFs across the board.

Let’s quickly have a closer look at how each of these ETFs performed from December 29 to December 31.

XRP ETFs Lead the Charge

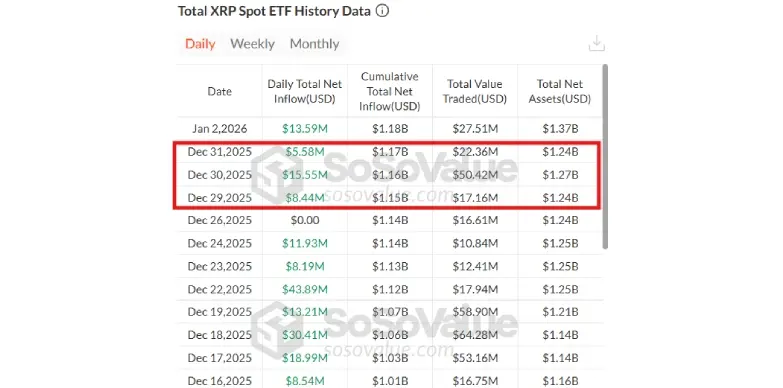

According to SoSoValue, XRP ETFs were the clear winners as they managed to bring in $29.57 million in net inflows from December 29 to December 31.

The strongest day as mentioned above was December 30, when the XRP ETF brought in $15.55 million. The XRP ETF is one of those ETF products that has still not experienced any outflows since the time of its launch. Bitwise’s XRPB led the inflow with roughly $8.2 million followed by Grayscale’s XRPE at $5.1 million.

Solana ETFs Gain Traction

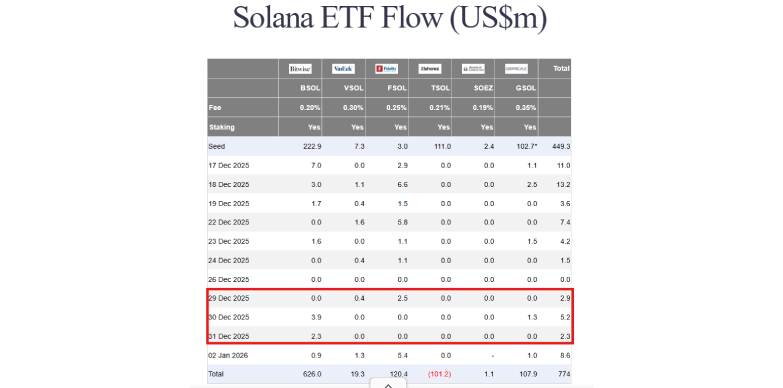

Solana ETFs also represented a solid gain between the said period (December 29-December 31), and it brought in $10.4 million in net inflows. On December 30, the strongest day for Solana ETFs as well, brought in $5.21 million in inflows. Grayscale’s BSOL led the pack with about $3.9 million in inflows.

The SOL ETFs has reported flat days but it has not reported outflows since its launch. This inflow indicates that there is a rising confidence in Solana’s ecosystem as activity picks up across the network.

Bitcoin ETFs Snap Back

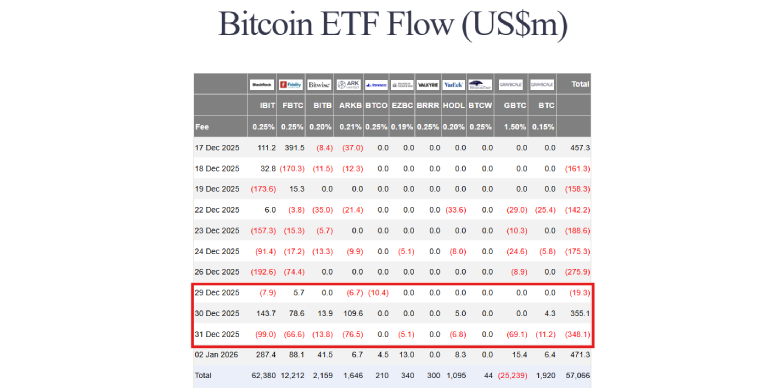

Bitcoin ETFs have faced pressure during this period. The product has recorded $12.3 million in net outflows as large investors engaged in tax-loss harvesting ahead of year-end. Despite the weak overall picture, sentiment shifted sharply on December 30.

On that particular day, Bitcoin ETFs saw a strong rebound where it saw an inflow of $355.1 million. BlackRock’s IBIT led the surge and managed to bring in $143.7 million alone.

Ethereum ETFs Mount Recovery

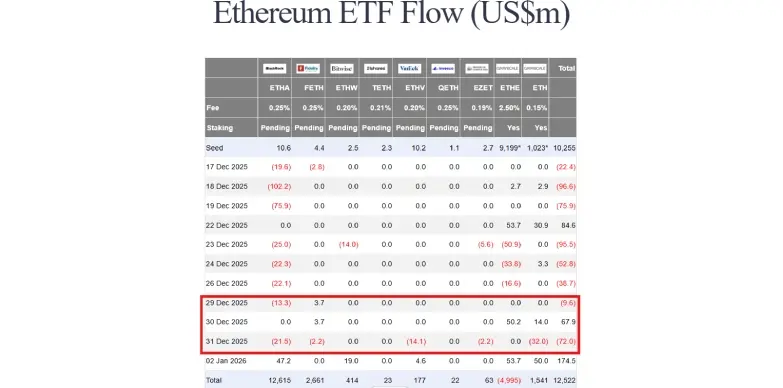

During the said timeline, Ethereum ETFs also struggled. According to SoSoValue and Farside Data, the product experienced $13.7 million in outflows as investors showed less interest compared to Bitcoin ETFs.

However, on December 30, offered a short turnaround, where Ethereum ETFs recorded $67.9 million in inflows, helping offset earlier losses. Grayscale’s ETHE led the rebound with $50.2 million.

January Inflows Mark a Strong Start to 2026 for Crypto ETFs

On January 2, crypto ETFs saw a great interest as all these ETF products experienced inflows. The investors returned after the holidays and started pouring money into these investment vehicles.

Bitcoin ETFs led with $471.3 million, followed by Ethereum ETFs at $174.5 million. XRP ETFs added $13.59 million, extending their late-December strength, while Solana ETFs managed to have an inflow of $8.6 million. The broad inflows indicate that there is a return of risk appetite across both major and alternative crypto assets.

Final Thoughts

Crypto ETF flows were mixed at the end of December due to year-end adjustments, where altcoins like XRP and SOL outshined BTC and ETH ETFs. A sharp rebound was observed on December 30 and fresh inflows in January indicate that investor interest has returned quickly, which points towards a positive start for the new year.

Also Read: Crypto ETF Flows Split: BTC, ETH Trail as XRP & SOL Surge