AVAX, the native cryptocurrency of Avalanche Network, jumped 4.5% to $18.7 during Wednesday’s U.S. trading session. This uptick aligns with the broader market recovery as Bitcoin leaps to $109,500 after facing several rejections. The buying pressure further accelerated as the AVAX network witnessed a strong rebound in network activity. Is a rally to $25 imminent?

Avalanche Network Activity Defies Price Correction

Over the past three weeks, the Avalanche price witnessed a sharp correction from $22.6 to $18.65, registering a 17.3% loss. The geopolitical tension in the Middle East was among the primary reasons behind this correction, along with a broader market correction.

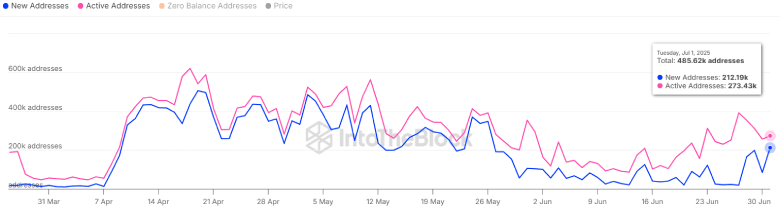

Despite the price decline, the number of active addresses on the Avalanche network experienced a sharp surge, increasing from 142.72K to 392.5K, representing a 176% rise. This surge reflects heightened on-chain activity and potentially dApps usage, staking, or new protocols gaining traction.

Simultaneously, the Sentora data shows a notable growth in new addresses from 196.5k to 273k now. This 40% growth indicates a substantial influx of new participants, reinforcing the AVAX adoption.

The notable growth in these metrics accentuates that the underlying fundamentals remain strong for Avalanche, and price recovery could follow eventually.

Also Read: Bitcoin Exchange Reserves Drop – Is a Breakout Brewing?

AVAX Price to End Multi-Month Correction With This Breakout

Since mid-May 2025, the AVAX daily chart has exhibited a steady downtrend, characterized by a series of lower lows and lower highs formations. Interestingly, this declining trend resonated strictly between two downsloping trend lines, indicating the formation of a falling channel pattern.

Generally, this chart setup drives a steady downtrend until the price breaks either boundary to reflect a change in market direction.

Currently trading at $18.64, the Avalanche price is just 6% away from challenging the overhead resistance. A bullish breakout from the above trendline will accelerate the bullish momentum and drive a rally past $22.67 resistance to chase the $27 high.

Alternatively, if the sellers continue to defend the channel resistance, the ongoing correction could prolong to the second half of July.

Also Read: Ethereum Bulls Rattle as 62K ETH Moves to Exchanges – What’s Next?