Key Highlights:

- On September 18, Bhutan shifted 913 BTC in two transactions amounting to a total of $107 million.

- The Himalayan kingdom manages 9,652 BTC, which is the sixth-largest sovereign hold of Bitcoin on the planet.

- The value of Bitcoin in Bhutan takes up close to 40% of the GDP, increasing the economic significance of crypto holdings.

On-chain activity around the sovereign Bitcoin reserves of Bhutan has attracted the attention of the global market once again. The Royal Government initiated two high-value transactions worth over $107 million on September 18 for the first time in a while. Thus, these transactions raised concerns about whether the Himalayan country is preparing to sell some of its digital resources.

Bhutan Government’s Latest BTC Transfers

The initial transfer, per data provided by Arkham Intelligence, was 343.107 BTC, which is worth $40.18 million, to an account that was created recently. That was followed by a second and larger movement, transferring 570 BTC worth $66.85 million into another wallet address. Such transactions are the most recent in a row of blockchain transactions tracked since the treasury of Bhutan this year.

Market observers have been much faster to note the growth. According to the Onchain Lens analysts, the trend in transfers is similar to the past trends, which ultimately influenced deposits to exchanges.

Such deposits typically caused waves of selling pressure. This kind of activity has led to fears that there may be the entry of another supply round in the days ahead that may have an impact on the momentum of Bitcoin. However, as of yet, no actual sale has been seen from the Bhutan government’s end.

The Country’s Sovereign Wealth in Bitcoin

The crypto holdings of Bhutan are 9,652 BTC, which have a value of about $1.13 billion by mid-September 2025. These holdings put Bhutan at position six as the largest government Bitcoin holder in the world, making the small country a part of the economic giants that have added BTC to their investment portfolio.

The size becomes even greater in comparison with the economy of Bhutan. Having a Bitcoin reserve equivalent to 40% of the gross domestic product (GDP), BTC has become a disproportionately large element of the country’s wealth. The effect of this concentration is that any mass disposition by Bhutan would certainly have an observable effect on both the domestic financial stability and international market sentiment.

Historical deals indicate a time factor in the operational strategy of the government. In July, there was a movement of wallets alongside Bitcoin, going into record levels of around 113,500. In August, a month later the government once more moved the money around, coinciding with the BTC/USD reaching roughly $124,500. The trend of timing the transfers in favorable price periods is repeated in the September 18 activity.

Mining Rewards to Billion-dollar Holdings

The relationship between Bhutan and Bitcoin goes back a few years. The issue of public attention emerged first in April 2019, when the country was reportedly quietly entering the crypto market. Bitcoin was currently trading around 5,000.

Druk Holding & Investments, which is the state-owned investment entity, was entrusted with the role of leading the mining activities. As of February 2021, Bhutan started receiving some of its first mining rewards with the first reward of 0.0267 BTC. In December 2021, the kingdom fuelled its ambitions, importing $193 million in processing units to establish large-scale mining infrastructure.

In May 2023, the program extended to form a partnership with Bitdeer Technologies. The partnership increased Bhutan’s power generation to 600 megawatts of mining power, using the rich source of hydroelectric power in the country to operate the power-consuming mining farms cheaply.

What’s Next for Bitcoin Price Trajectory?

The most recent sovereign transfers are possible at the time when Bitcoin traded around $117,000, seeing an increase of 1% in the last 24 hours. The market is excited by the fact that the U.S. Federal Reserve reduced the interest rates by 25 basis points on September 17, a move that has largely favored the risk assets.

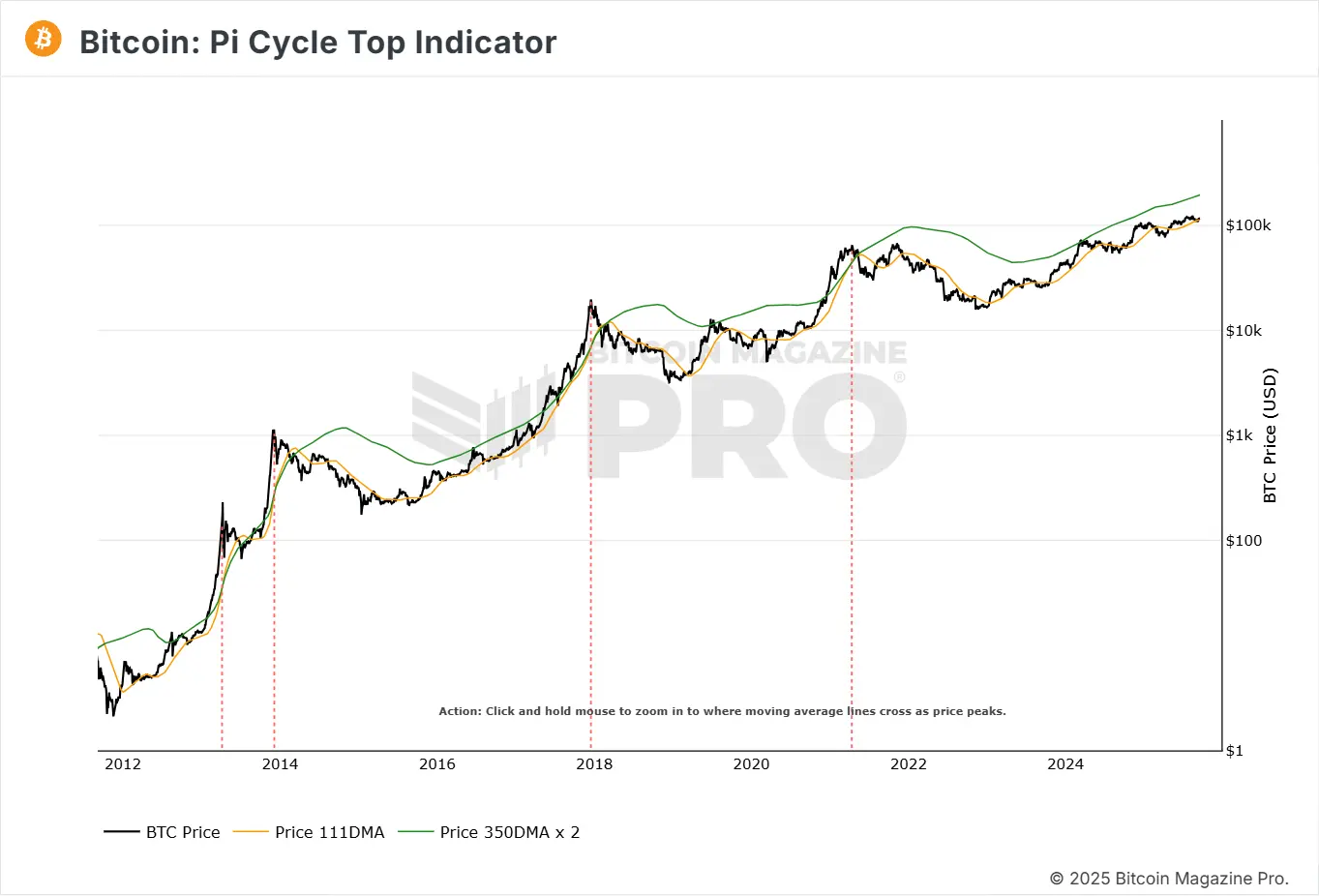

But technical indications start splitting. In the past, crypto analyst Rekt Capital has identified the Pi Cycle indicator as a useful instrument in the identification of bull market tops. In sharp contrast to the analysis of the past cycles where there is convergence of the moving averages, in this cycle, one can notice that the moving averages diverge with the 111-day moving average of approximately just above 111,000 and the green moving average approaching 200,000.

The previous cycles had peaks around 518 and 550 days after the 2017 and 2021 halvings, respectively, which put the next possible peak in mid-October and mid-November this year. The long-range picture may not be past December, but the bizarre behavior of the moving averages has raised some doubts on whether the Pi Cycle crossover indicator will show up this time round.

Also Read: Bitwise CEO Sees Credit, Borrowing Driving Next Crypto Wave