Ethereum is back with a bang, and it is not just a blip. It is a full-on market moment. The world’s second-largest cryptocurrency by market cap has rocketed up sixty percent in just a few weeks. It went from $2,400 to $3,900 like it had something to prove. This is not a modest rebound. This is an aggressive sprint fueled by a mix of real inflows from spot ETFs, a sudden hunger for staking tokens, and rising on-chain activity that is hard to ignore.

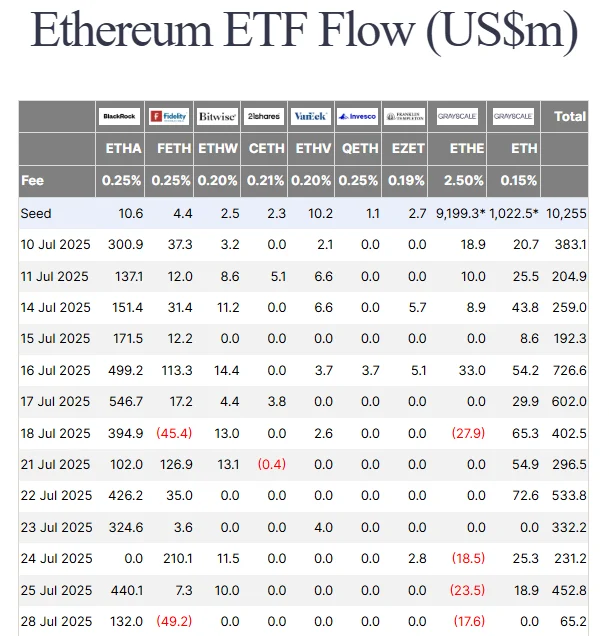

According to Farside UK, Ethereum ETFs saw a total inflow of over $9,438 million since 10th July. The money is coming in fast, and the charts are starting to look like they have stage fright. The $4,000 level is not just psychological. It is the tightrope where high-leverage traders start sweating.

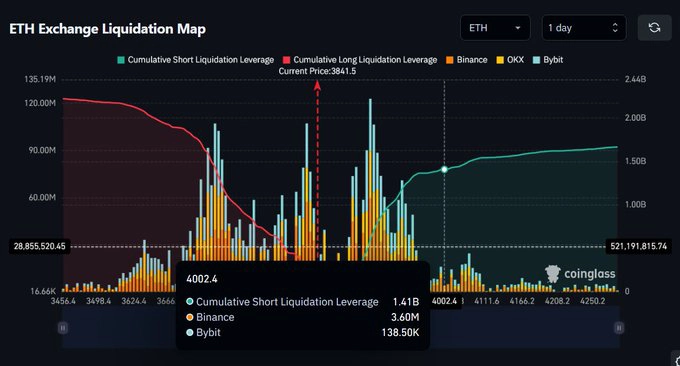

Liquidation Looms: Over $1.4B at Stake

A crossing of $4,002 could liquidate over $1.4 billion in shorts. Binance alone is sitting on $3.6 million worth of downside risk. Bybit traders could be staring at $138,500 in losses the moment ETH taps that resistance. That looming threat of liquidation is not slowing things down. It is accelerating them.

This is textbook short squeeze material. ETH keeps teasing the ceiling. And every time it does, someone somewhere is biting their fingernails, wondering if it will hold or snap. If that barrier breaks, the upside could turn into a vertical climb. For the shorts, it would be a tumble off a cliff.

ETH Dominates Over BTC

Meanwhile, Bitcoin is playing it cool. But ETH? ETH is turning heads. It has beaten Bitcoin across nearly every metric this month. Ethereum-native assets, especially staking tokens, are showing new strength. And while BTC dominance ticks lower, Ethereum might just be getting ready to headline the next act of the 2025 bull cycle.

So now the question floats through the user’s mind: what is next? Sentiment is tilting bullish. Break $4,000 and the market could lurch toward $4,500 or maybe even $5,000 before the next real ceiling. But crypto has a habit of humbling latecomers. If ETH gets rejected here, cascade liquidations could flip the script fast, and the bulls might not know what hit them.

Ethereum Price Rally Sparks Interest in Market

Stepping back, this rally is not happening in a vacuum. The entire crypto space is waking up. Institutions are sniffing around again. Retail is showing teeth. Ethereum is not just going up because people are bored. It is doing so because its tech stack is evolving. Its ecosystem is growing. And DeFi is whispering that it might be ready to roar again.

Bottom line? Ethereum is not trying to live in Bitcoin’s shadow anymore. It is casting its own. With more than $1.4 billion in shorts parked just above resistance, the next few days could either be fireworks or fallout.

Watch $4,000. The market will not whisper much longer. In crypto, either the bears get to eat, or the bulls trample everything. Right now, the matador is wearing an Ethereum logo.

Also Read: TRON Price Breaks Key Resistance as Daily Revenue Soars to $2M