Key Highlights

- November 19, Bitcoin dropped below $89,000 with 4% crash on the daily chart

- Abu Dhabi Investment Council has announced an additional $250 million worth of shares in BlackRock’s iShares Bitcoin Trust (IBIT)

- According to the crypto analyst, the SuperTrend indicator is showing a major downturn for Bitcoin

On November 19, Bitcoin plunged below $89,000 with a 4% drop on a daily chart. It holds a market capitalization of $1.77 trillion.

At the time of writing, BTC is showing a slight rebound as it is currently trading at around $90,108.83 with $77.19 billion in trading volume in the last 24 hours, according to CoinMarketCap.

Crypto Trader Raises Sell Signal for Bitcoin

According to Ali, a crypto analyst on X, the SuperTrend indicator, a popular technical analysis tool, is showing a major downturn for Bitcoin.

— Ali (@ali_charts) November 18, 2025

This indicator has a documented history spanning over a decade of accurately identifying major shifts in market trends.

According to its historical data, whenever this indicator has turned bearish, it has consistently been followed by a major correction in Bitcoin’s price. Here is the historical data of previous sell signals:

- February 2014: 75% Crash

- January 2018: 73% Crash

- October 2019: 54% Crash

- May 2021: 38% Crash

- January 2022: 67% Crash

The main factor is the indicator’s historical consistency. On every past occasion that the SuperTrend has flipped to a sell signal on the weekly chart, Bitcoin’s price has subsequently experienced a major drop.

The indicator has now entered this sell mode once again, which suggests that BTC could be entering a new corrective phase in the market.

According to Ali, if the current signal follows the historical pattern, the decline could be substantial. The average price drop from all previous SuperTrend sell signals calculates to approximately 61%.

If this happens, it applies this average decline to Bitcoin’s recent market structure, which hints toward a potential price target near the $40,000 level.

However, it is crucial to note that this signal does not guarantee such a move will occur. But based on more than 10 years of historical data, it is a major level that market participants are closely watching.

Abu Dhabi Investment Council Increases Bitcoin ETF Holdings

The Abu Dhabi Investment Council has substantially increased its investment in a major BTC exchange-traded fund (ETF). According to a report, the sovereign wealth fund purchased an additional $250 million worth of shares in BlackRock’s iShares Bitcoin Trust (IBIT).

🇦🇪 ABU DHABI INVESTMENT COUNCIL: “We see Bitcoin playing an increasingly important role alongside gold.” – Bloomberg pic.twitter.com/bAXCzeJfUZ

— Bitcoin Archive (@BitcoinArchive) November 19, 2025

This investment comes when the cryptocurrency market is witnessing a massive liquidation, which saw the value of Bitcoin fall by approximately 20% since the end of September.

The spokesperson stated that both assets serve to diversify investment portfolios and confirmed the Council’s intention to continue holding both as part of its ongoing strategy. This recent purchase comes after an initial investment of $436.9 million made in the same ETF back in February of 2025.

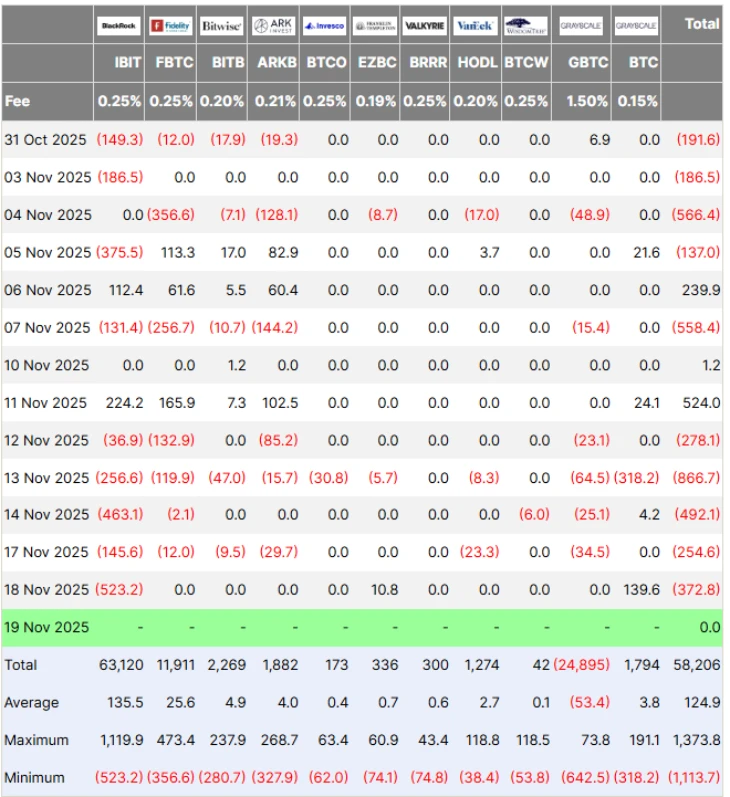

Bitcoin ETFs See Major Outflows in November

Investors have pulled nearly $3 billion out of U.S. spot BTC ETFs this month, according to data from Farside Investors. This major withdrawal marks a sharp reversal for a market that had previously seen strong investor demand. The trend shows a change in sentiment as major funds experience substantial redemptions.

(Source: Farside)

Leading this wave of outflows is BlackRock’s iShares BTC Trust (IBIT). The fund has now become the largest source of redemptions.

In a single trading session, the fund saw $523 million withdrawn, representing its largest 1-day outflow since it began trading. Of the total $3 billion withdrawn in November, the BlackRock fund accounts for approximately $2.1 billion. This constant streak of outflows shows the depleting trust of institutional investors in the crypto market. This downward trend was also witnessed in other cryptocurrencies like Ether, XRP, Solana, BNB, and others