The decentralized peer-to-peer cryptocurrency Litecoin plunged over 2% during Friday’s U.S. trading session. This selling pressure aligns with the broader market downtick as Bitcoin takes a sudden dive below $104,000. While geopolitical tensions in the Middle East continue to pressure most major assets into a prolonged correction, the LTC price builds a bullish continuation pattern, preparing for a leap above $100.

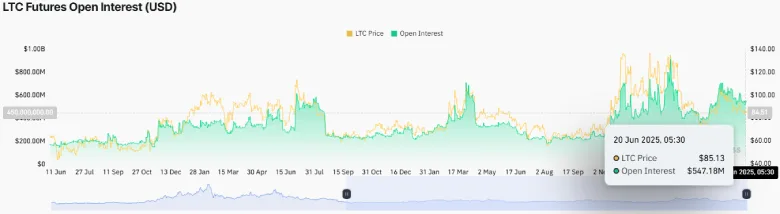

Litecoin Faces Hurdles as Futures Open Interest Drops

In the last two weeks, the cryptocurrency market witnessed a notable downturn amid the escalating military action between Israel and Iraq. As a result, the Bitcoin price slipped below $105,000, and a majority of major altcoins, including Litecoin, followed suit.

The LTC price formed a lower high formation at the $94.17 mark before falling 12.2% to its current trading price of $82.64.

Along with price correction, the derivative market data showed a notable decline in its futures open interest, reinforcing the risk of a prolonged downtrend.

According to CoinGlass data, Litecoin’s OI value has declined from $707.3 million in mid-May to $547.2 million currently, representing a 22.6% loss. This decline suggests that many traders are closing out their futures positions, possibly due to a lack of conviction in the asset’s short-term direction amid the geopolitical crisis.

As speculative interest wanes and volatility tends to decrease, the coin price may enter a consolidation phase unless new catalysts emerge.

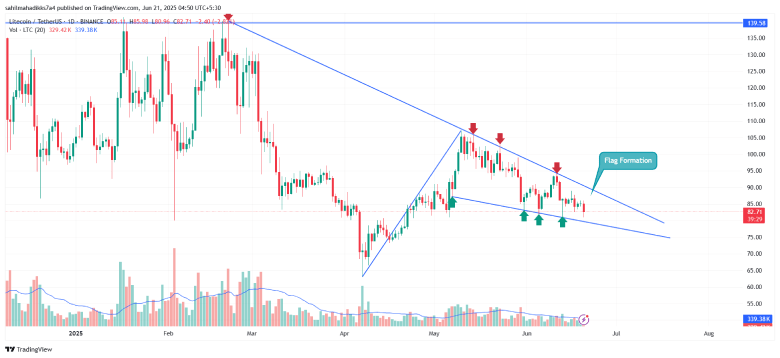

Flag Pattern Prepares a Rally for $120

A deeper analysis of LTC’s daily-hour chart reveals that the recent price correction has resonated strictly within two falling trendlines, indicating the formation of a bull flag. Typically, the chart setup shows a long pole demonstrating the dominating trend, followed by a temporary correction to regain bullish momentum.

Amid the declining trend in OI value and the Middle East war, Litecoin could plunge another 4% to seek support at the flag’s lower trendline. So far, a price retest of the lower trendline has bolstered buyers, leading to a renewed recovery that challenges the overhead resistance.

If history repeats, the buyers could drive a bullish upswing and potentially breach the resistance trendline, signaling the continuation of the uptrend. The post-breakout rally could push the asset to $120, followed by $140.

Also Read: Ethereum Holds $2.5K Amid War Fears as Whale Buys Rise