Key Highlights

- On Nov 18, the U.S. Banking Regulator, OCC, released a statement, stating that banks can now hold digital assets to pay blockchain fees

- With new guidance, Banks will be able to hold small reserves of digital assets like Bitcoin or Ethereum

- As major U.S. banks are preparing to integrate crypto-related services in the upcoming months, this regulatory clarity will bring much-needed clarity for them

On November 18, the United States government gave national banks the green light to hold cryptocurrencies on their balance sheets.

The announcement comes from the Office of the Comptroller of the Currency, which declares that the new guidance will allow banks to hold digital currencies like Bitcoin and Ethereum to pay for blockchain network fees (also known as Gas Fees).

What Does This Statement Mean for Banks

This statement from the OCC will provide much-needed clarity to banks to integrate digital assets into their existing financial infrastructure.

When banks offer services like holding crypto for clients or issuing their own digital dollars, they need a small reserve of crypto to pay for transaction validation on networks like Ethereum.

(Source: occ.treas.gov)

Before this rule, there was ambiguity for banks, and in some cases, they required special permission for these holdings. It slowed down the integration of new digital asset innovations like stablecoin.

But now with the new rule, they can now plan for these costs as a standard part of their business.

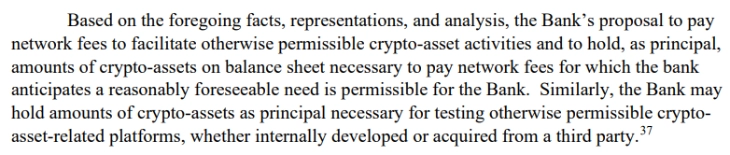

“The OCC published Interpretive Letter 1186 confirming that a national bank may pay network fees, sometimes referred to as “gas fees,” on blockchain networks to facilitate otherwise permissible activities and hold, as principal, amounts of crypto-assets on balance sheet necessary to pay network fees for which the bank anticipates a reasonably foreseeable need. The OCC also confirms that a national bank may hold amounts of crypto-assets as principal necessary for testing otherwise permissible crypto-asset-related platforms, whether internally developed or acquired from a third party,” stated in the official announcement.

A Year of Major Crypto Policy Developments in the US

This decision by the OCC is the latest in a series of pro-crypto reforms from the U.S. government in 2025, thanks to U.S. President Donald Trump and his new administration.

This evolution started in January 2025 with an executive order from President Trump, in which he revealed his intention to make the US a crypto capital of the world.

Not just flowery promises, he also directed his administration to bring much-needed regulatory clarity with clear guidelines.

One of the major actions this year includes a joint statement from the SEC and CFTC in March, where they removed previous warnings for banks to join the bandwagon of crypto opportunities.

In July, the U.S. President signed the GENIUS Act into law, which became the first federal rules for stablecoins. These are digital currencies pegged in a 1:1 ratio with underlying assets like USD. This law mandates that stablecoin issuers must hold enough cash reserves to back every token they launch. This regulation also brings these stablecoin issuers under regulatory oversight.

Not only this, but other new laws have clarified which government agency regulates different types of digital assets. This has ended the tussle between regulatory agencies like CFTC and SEC to decide which cryptocurrencies fall into which regulatory umbrella.

Major U.S. Banks Prepare to Launch Crypto Services

While the cryptocurrency sector is finally getting regulatory clarity, many American financial institutions and banks are rushing to integrate crypto-related services into their existing financial infrastructure.

JPMorgan Chase is planning to expand its crypto custody services through a partnership with Coinbase by early 2026. It also prepares to accept Bitcoin and Ether as collateral from institutional clients for loans.

A group of major banks, like J.P. Morgan, Bank of America, Citi, and Wells Fargo, is in the discussion to launch a joint stablecoin backed by the U.S. dollar. Meanwhile, financial custodians like BNY Mellon and State Street are building new platforms to allow spot trading of cryptocurrencies for their institutional clients.